According to Taiwan-based EnergyTrend, India’s imposition of safeguard tariffs for two years, which came into effect on July 30, will do little to boost the country’s domestic solar PV manufacturing landscape.

Citing its comparatively small scale and lack of competitiveness on an international level when it comes to both quality and prices, the analysts expect the tariffs to have an overall negative impact on the Indian market in the second half of this year, with demand set to be under 3.5 GW.

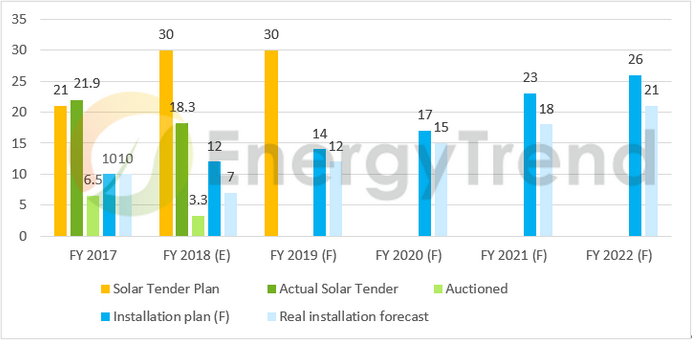

Furthermore, it expects just 8.5 to 9.6 GW to be installed throughout 2018, with a 30% demand decrease forecast for the fiscal year 2018 (April 2018 to March 2019), from the previous fiscal year. This will put at risk the country’s goal of installing 100 GW of solar by 2022.

Increased cost pressures

In particular, EPC companies and project developers can expect to experience increased cost pressures.

Following on from the safeguard announcement, there were fears of an immediate 10-15% tariff hike. And, in the 200 MW Odisha auction, which took place just a day after the tariff announcement, the winning tariff was Rs 2.79 (US$0.041) – an increase, although not as bad as many had feared.

However, “The PPAs have not been executed between the State and the bidders yet. Hence, one should not consider the low tariff at the Odisha auction as a benchmark for post duty-imposition tariff,” solar consultant Urvish Dave told pv magazine. He added that overall, he is anticipating “a minimum tariff revision and a hike of around 12-18% per unit from … bidders.”

The Energy & Resources Institute (TERI), meanwhile, said the duty will result in higher average power purchase costs for the buying utilities, as well as higher consumer costs.

China still competitive

The safeguard tariffs have been imposed on solar PV cells, whether or not assembled in modules, from China, Malaysia, Taiwan, Europe and the Americas.

Starting at 25%, they will be gradually reduced over a two year period, to 15%. As aforementioned, the aim is to protect India’s domestic industry.

Underlining what other players have been saying, even before the tariffs were applied, TrendForce states that they will not achieve the desired effect. In addition to the issues outlined above in the Indian market itself, China’s PV policy changes in May, which will see demand in China also decrease this year, are forcing manufacturers to look overseas to offload their product.

“The entire PV supply chain in China has experienced falling prices and excess capacity that needs to be directed to the overseas markets,” writes TrendForce. “As a result, China-made PV modules will remain competitive in the Indian market even after being slapped with a 25% duty.”

It adds that in addition to India, Chinese manufactures will also be looking to “aggressively expand” in Europe, Australia, Mexico, and North Africa.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.