Renewable energy – a bona fide investment class

Germany was the first country to provide support for investments in renewable energy through the introduction of feed-in tariffs (FIT) in 1990. By 2017, 173 countries had introduced policies to support investment in renewable energy through FIT and other support schemes [1]. These policy mechanisms sought to provide investors certainty on the key parameters for a successful project: price, volume, and off-take counterparty risk. They enabled a significant scaling-up of private capital to support renewable energy, mainstreaming renewable energy as a bona fide investment class.

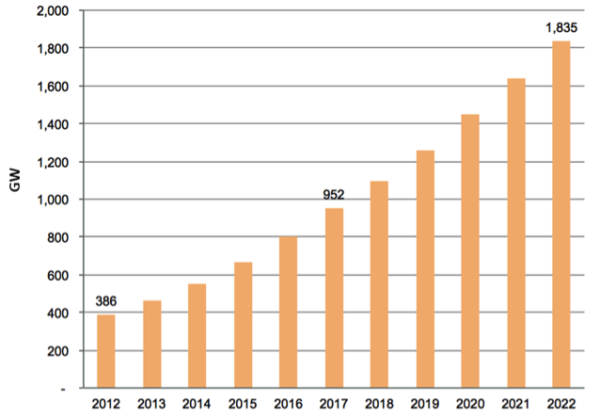

This significant capital allocation to the renewable energy sector created a virtuous cycle for the deployment of renewable energy by increasing competition for projects and reducing the cost of capital, which led to a reduction in the delivered cost of electricity. The expansion of investment in renewable energy, especially in solar and wind, is expected to continue in the coming years (see Figure 1).

The increased investment in renewables has also enabled equipment manufacturers to achieve increased economies of scale. This has brought down the capital cost (CapEx) to build solar PV and on-shore wind projects by 68% and 20% respectively, between 2010 and 2017 [1], further reducing the delivered cost of electricity and increasing the attractiveness of renewable energy to governments and off-takers.

A move to auction procurement

More recently, many countries have shifted to auction-based procurement for renewable energy capacity. The International Renewable Energy Agency (IRENA) reports that by 2016 about 67 countries had adopted auction programmes []. This has driven further, often dramatic, reductions in the levelized cost of electricity (LCOE). Recent auctions for wind and solar capacity in Saudi Arabia bear this out: the 300 MW Sakaka project (PV solar) was awarded early in 2018 at US$23.4 /MWh; while the 400 MW Dumat al-Jandal project (on-shore wind) received bids in July 2018 in the range of US$21.3–33.9 /MWh.

The illusion of ‘grid parity’

This paradigm shift in the cost of solar PV and wind has caused a number of commentators to herald the arrival of ‘grid parity’ for these technologies. However, some caution is necessary regarding the use of the term ‘grid parity’: The traditional definition of ‘grid parity’ is that it is achieved when the LCOE of a renewable energy source is less than or equal to the LCOE of conventional power or the average electricity price on the grid. But this is a flawed comparison for three reasons.

First, renewable energy is a fundamentally different product to conventional energy, due to the inherent dispatch constraints that exist for renewables, rendering an LCOE comparison meaningless. Competitive electricity markets are subject to significant time-of-day and seasonal generation and price fluctuations, meaning that the price achievable for renewables will vary substantially from the average on-grid price, due to their generation profile.

Second, the analysis requires an apples-for-apples comparison. To date, most renewable energy projects have relied on a certain off-take from a creditworthy counterparty, providing significant confidence in the project’s revenue. A project’s LCOE derived with this underpinning will be materially different from the LCOE for an equivalent project subjected to the vagaries of a competitive electricity market (i.e. where price and volume risk exists), due to the very different access to, and cost of, capital available to these projects.

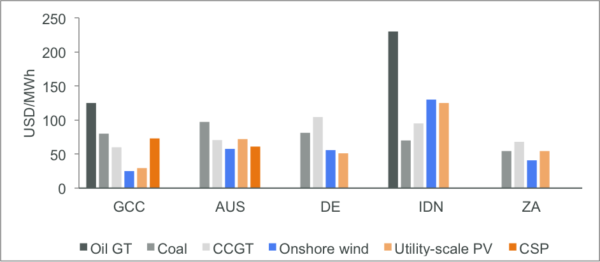

Third, neither ‘grid parity’ nor LCOE for a renewable source are universal concepts. The principal cost drivers for a renewable energy project (energy resource, scale, CapEx and cost of capital) differ substantially from country to country (and even regionally in many countries). Figure 2 illustrates the approximate LCOE for utility-scale renewable and conventional energy sources in selected countries.

The litmus test for the competitiveness of a renewable project in a post-subsidy environment should simply be: is the project economically viable, from the point of view of a rational investor, taking account of the prevailing and expected market forces, including the projected revenue, operational and financial parameters.

conventional energy technologies in selected countries. GCC= Gulf Cooperation Council countries; AUS = Australia; DE = Germany; IDN = Indonesia; ZA = South Africa; GT= Gas turbine; CCGT = combined cycle gas turbine; PV = photovoltaic; CSP = concentrated solar power. Source: BNEF (2017), IRENA (2016, 2018), Fraunhofer Institut (2018), IEA (2016), Businesswire (2017), DEWA (2018), SCIELO (2016)

Image: Institute for Solar Energy Research Hamelin (ISFH)

Expanding renewables’ capacity and penetration

Despite these cautionary words, it is clear that the price of electricity generated from renewables is increasingly competitive relative to conventional energy sources, in most regions.

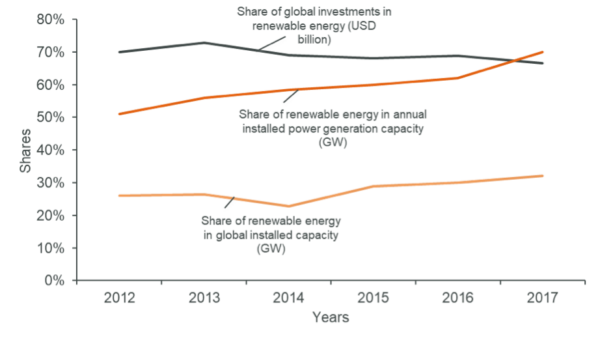

Substantially, because of its increasing competitiveness, the capacity of renewable energy has grown considerably, in recent years both in absolute terms as well as its relative share of installed capacity and generation. Figure 3 illustrates that the share of renewable energy capacity additions as a percentage of total annual capacity additions has risen from about 50% in 2012 to about 70% in 2017. This has been achieved despite the share of investment in renewables remaining more or less unchanged over the same period, underscoring the impact of falling CapEx to install renewable energy capacity.

There has also been an expansion of the share of renewables in the global stock of installed capacity to about 32% by 2017. Many developed countries have significantly higher penetrations of renewables in their energy systems, notably in Europe – for example, more than 56% of Germany’s installed capacity is renewable energy.

The rise of Renewables 2.0

The combined effect of increasingly competitive renewable energy and an increasing proportion of variable supply renewable energy on grid systems is leading to an inflection point for the renewable energy sector – a transition to what we call ‘Renewables 2.0’. There will be significant, wide-ranging ramifications of this post-subsidy ‘Renewables 2.0’ era for all market participants. In particular, we will see a greater need for flexibility and a range of new market opportunities that will require new revenue models and increasingly complex financing solutions.

In regions just starting their journey toward a clean and sustainable renewable energy supply, government-backed offtake arrangements (‘Renewables 1.0’) will continue to be the main driver in the near- to mid-term.

The need for flexibility

As the penetration of renewables increases, a key challenge will be to meet the growing need for flexibility by managing and mitigating the impact of increasingly variable and bi-directional energy flows. Energy storage can do the trick by providing ancillary services or shaping/shifting renewable energy supply both in front-of-the-meter (on-grid) and behind-the-meter.

Additional flexibility is enabled by the ongoing digitalization of the energy sector on both the supply and demand side. For example, the digitalization of energy can help to optimize the utilization of generation and grid assets, aggregate distributed energy resources, including through virtual power plants, and improve demand side management.

To enable this, and to maintain a reliable, secure electricity supply, regulators and grid operators will need to respond to ensure that market pricing provides adequate and timely signals and incentives for investors to encourage the required infrastructure investments.

New revenue models will require new financing solutions

Falling prices for renewable energy supply is encouraging regulators in many countries to withdraw subsidies and state-sponsored off-take guarantees. The rationale being that if renewables have achieved ‘grid parity’, they no longer need support mechanisms to compete effectively in a competitive market.

In some countries, project developers have anticipated this shift and are already side-stepping government-mandated schemes, focusing on market-based projects. These market-based project opportunities will involve new revenue models. However, they may still need a level of committed or more secure revenue from a credible counterparty to access capital and/or bring down their cost of capital. Parallel market developments may provide a partial solution to this challenge. For example:

An expanding interest by large companies seeking to enter into corporate PPAs – to meet sustainability commitments and to hedge energy costs – provides an opportunity for project developers to secure a committed revenue stream(s), albeit with diversity in counterparty risks and some variability in the duration of off-take agreements. In 2017, 3.9 GW of corporate PPAs were contracted across the USA, Europe, the Middle East and Africa [2]. In Europe, Spain and the Nordic countries have been active regions for corporate PPAs.

Project developers are also increasingly examining the prospect for smarter, hybrid projects, coupling renewables with energy storage. A number of projects have been proposed in Australia that incorporate wind and/or solar plus energy storage and, in some cases, adding energy storage to existing renewables projects.

Alternatively, hybrid projects incorporating renewables and energy storage in conjunction with conventional energy (gas, heavy fuel oil (HFO), diesel) have been proposed to reduce the overall cost of supply and emissions for both on- and off-grid solutions. These solutions are especially suitable for isolated grid systems and stranded customers that have traditionally relied on relatively expensive liquid-fuel generation. Such solutions make a lot of sense in archipelago countries, like Indonesia and the patchy, unreliable grid networks in a number of developing regions, notably in Sub-Saharan Africa.

Expanding the scope of projects to incorporate energy storage will enable projects to shape energy supply to meet peak load requirements, which may have higher, more certain revenue parameters.

Project developers will inevitably be subject to some measure of market risk across the project life and/or rely on multiple ‘stacked’ revenue streams. Understanding the economics underpinning future projects will inherently require project developers, investors and their advisors to employ significantly more sophisticated project analytical tools.

Conclusions, opportunities and challenges for Renewables 2.0

Renewable energy has firmly established itself as a bona fide investment class over the past 10 to 15 years. To date, much of the investment flowing into the sector has relied on FITs and other government support schemes that gave investors the confidence in the key parameters that underpin project revenues.

The increased capital allocation to the sector led to falling capital costs and a significant expansion of renewable energy. This has driven down both the capital cost and the on-grid cost of energy from renewable sources. Today these energy sources are competitive with conventional energy sources in most markets, drawing into question the need for continuing government support mechanisms. This post-subsidy Renewables 2.0 era will bring both opportunities and challenges for market participants.

There will be a growing need for flexibility to manage increasingly complex energy grids that rely on greater variable generation and bi-directional energy flows. This will provide opportunities for energy storage and hybrid solutions, as well as increasingly sophisticated digitalization of energy supply and demand management. Regulators and grid operators will need to evolve system regulations and grid operating codes to meet these new challenges.

Projects will become more complex, relying on multiple, more complicated revenue streams. Developers, investors, and their advisers will need significantly stronger analytical skills and predictive models to assess, structure and finance projects.

The energy future is renewable, but it will entail greater complexity in the post-subsidy Renewables 2.0 era.

References

[1] IRENA (2017), “Policies to Unlock a Solar Future. Letting in the Light: Unlocking the Potential of Solar Energy.”

[2] IRENA (2018), Corporate Sourcing of Renewables: Market and Industry Trends – REmade Index 2018. International Renewable Energy Agency, Abu Dhabi.

About the author

Duncan Ritchie leads Apricum’s project advisory practice, its activities in the water, waste and built environment sectors and its expansion in the Southeast Asia, Australia-Oceania, sub-Saharan Africa and MENA markets. He has over 25 years’ experience in investment banking, finance and project development in the energy and infrastructure sectors, and has advised private clients, funds, governments and multilateral and bilateral development agencies on infrastructure development strategies, procurement and risk management, including under Public-Private Partnership investment models.

Apricum offers a range of services that specifically address the increased revenue complexity of Renewables 2.0 projects involving aspects such as corporate PPAs, merchant risk, stacked revenue and stochastic analysis. The technical complexity of projects will also increase in line with increased variable capacity, decreased grid stability, the need for “firm power” and the integration of energy storage. With superior domain knowledge, commercial insight and a best-in-class financial modelling team, Apricum is ideally placed to bring greater value and competitiveness to each transaction to support its clients (platform vehicles, project developers, institutional and other investors and government/procuring agencies).

For questions or comments, please contact Apricum Partner Duncan Ritchie.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.