In moving to meet those targets, total renewable energy installations in India reached 75GW by September 2018, representing 21% of total installed capacity and generating a record high of 11.9% of all electricity in the September 2018 quarter.

Such ambitious targets have invariably encountered various headwinds and challenges. Recent months have brought some of these to the fore, including questions over the grid capacity to incorporate such a high variable energy penetration so quickly.

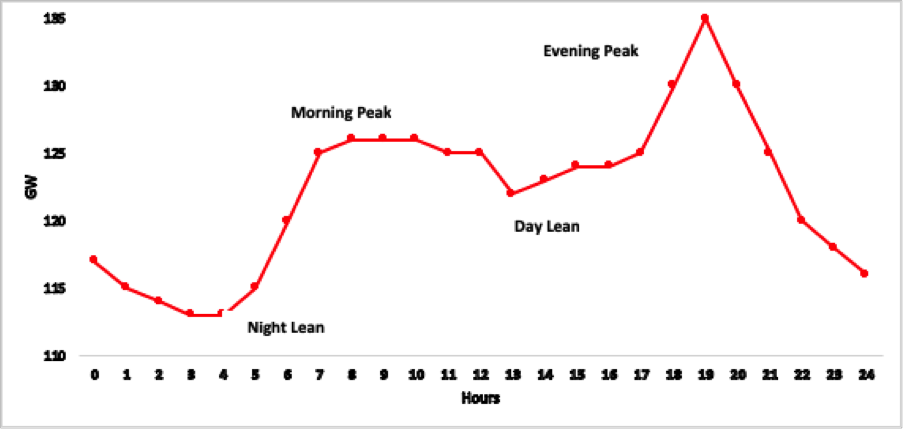

Compared to the all-India average, maximum and minimum demands have increased over the years at a phenomenal rate. While supply has also increased, it caters more to the traditional power load requirements established with increasingly outdated thermal coal-fired power plants. Further, Indian load profiles are becoming “peakier”, with sharp morning and evening peaks, as illustrated in Figure 2 below.

At this juncture, electricity production tariff (pricing) structures need to be better aligned to incentivise faster ramping and flexible power generation. This is important in delivering at least cost on intermediate and peaking power needs, while also providing grid stability with the increasing share of variable renewable energy. Suitable supply side pricing structures need to be evolved to better incentivise flexible generation solutions. Further, as a demand side response, time of day metering and pricing structures for consumers also needs to be evolved for peak load management.

In this briefing note, we explore the need for creating a market that provides signals for balancing capacity and flexible generation to balance power supply and demand, particularly in meeting peak demand. We further explore the need for flexing the energy system on account of the increasing share of variable renewable energy generation, even as overall demand continues to grow at a strong 5-6% per annum. We explore demand and supply side responses that can meet the peaking and flexing needs of Indian energy systems and the policy design (like time-of-day pricing) that can enable setting up of such capacity.

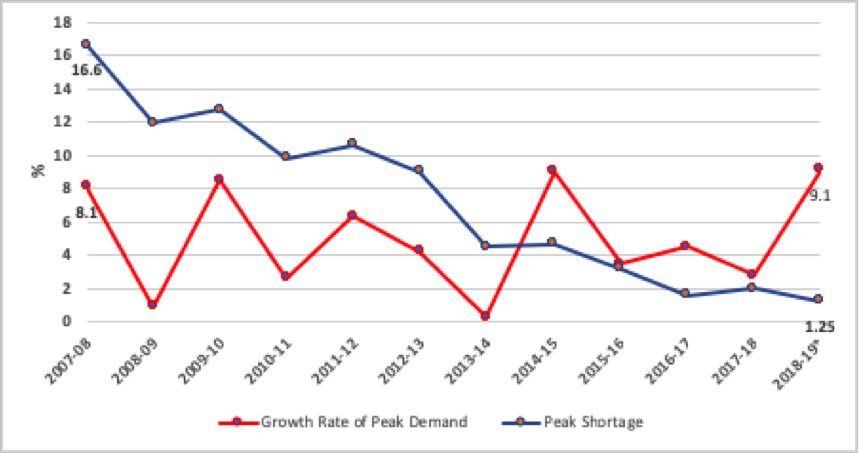

Trends in energy and peak shortages

To meet growing energy demand, India has successfully added enormous new power generation capacity over the last decade, reducing the country’s energy deficit from a massive 8.5% in 2010 to just 0.7% in 2017-18. Although peak power demand deficits have also dramatically reduced from 9.8% in 2010 to just 2% in 2018, they are still apparent.

While the rate of increase in peak demand growth has fallen over the last decade, huge load variations during the day reflect people’s requirements for electricity during different time periods, such as increased demand during early morning or evening.

Fluctuating load variations require grids to provide additional peaking capacity, i.e. further energy generating capacity to meet peak demand. However, with the state of the existing tariff structure in India, it is not lucrative for power developers or investors to set up fast ramping capacity to meet peak demand.

Source: CEA/IEEFA

Current trends in electricity requirements

The amount of electricity that needs to be generated at any given time to meet energy demand in India varies between states depending on population and occupation (i.e. domestic, agriculture, commercial, and industrial), temperature and seasonality, and cultural practices.

A typical load curve illustrating the national variation in demand (aggregated electrical load of the different states in India) over a specific time is provided in Figure 2.

Image: NLDC/IEEFA

In October 2018, peak power demand in India reached 180GW, an increase of 9.8% over the peak power demand recorded in the prior corresponding period.

Continued strong economic growth, an increasing number of electricity connections under the Saubhagya scheme – an Indian government project to provide electricity to all households, the roll-out of electric vehicles, and other similar initiatives, will all add to the increase in peak power demand into the future.

Further, additional variables such as energy efficiency technologies, seasonal changes in temperature and the growing use of air conditioners infer that the shape/width/magnitude of India’s load curve will likely undergo change into the future.

For instance, as per the International Energy Agency’s (IEA) World Energy Outlook 2018, the number of households in India owning an air conditioner (AC) has increased by 50% in the last five years. By 2040, two-thirds of households in India are projected to own an AC unit, a staggering 15-fold increase from today. While the share of cooling in electricity system peak loads is ~10% in 2016, this share will likely increase to over 40% by 2040 under the IEA’s New Policy Scenario, altering the shape/width/magnitude of load curve substantially.

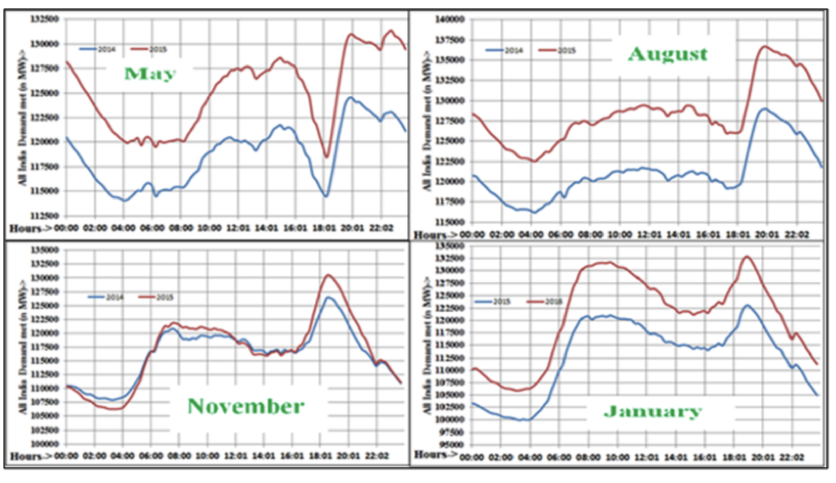

As illustrated in Figure 3, India’s load curves vary considerably between seasons:

- The month of May has a peak during the day, and later in the evening;

- August has a relatively flat profile during daylight hours, with a small peak in the evening;

- November shows a sharp evening peak; and

- January shows two distinct peaks: a sharp morning peak and a sharp evening peak.

Image: Adapted from NLDC

Figure 3 also implies load ramp up and ramp down rates are varying significantly as a consequence of the different seasons. In the evening hours of August there is a rapid ramp up of load between 18 and 19 hours, while in November there is a significant ramp down of load to 10.8% between 19 and 20 hours.

The load curve also varies significantly between different states in India. A few leading states like Karnataka, Tamil Nadu. Maharashtra, Gujarat and Rajasthan have invested in renewables and the share has reached ~30-35% of the total installed capacity. Such states will witness higher load ramp up and ramp down rates, requiring higher balancing capacity for grid stabilisation.

The current pricing system in India is a largely flat tariff providing little incentive for network or consumer efficiency through load smoothing. If India took into account the different categories and types of energy demand, and the variations in supply and costs of service, it would likely bring efficiency gains from differential pricing at peak periods.

Better consumer price signals during peak periods will incentivise the use of energy during periods of low demand and reduce the burden on the grid, while a time-of-day (ToD) pricing signal would better incentivise variable generation ‘kicking in’ at times of peak demand.

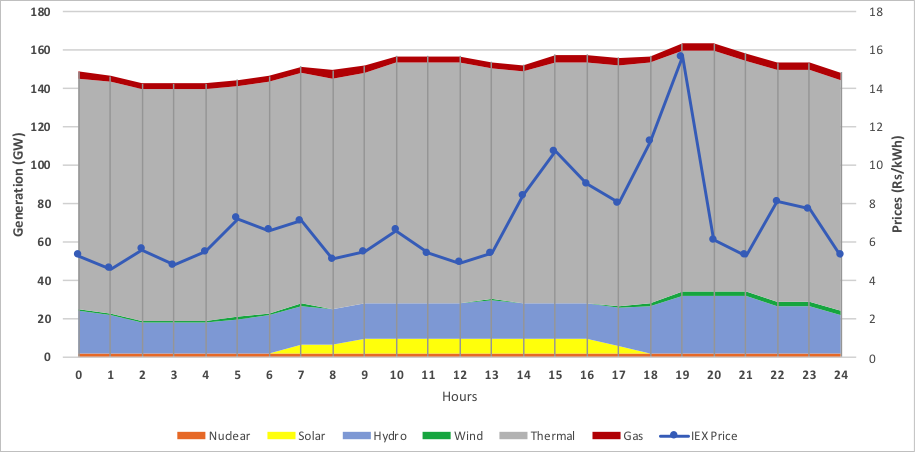

Current trends in electricity supply and prices

India’s electricity supply has historically been largely coal dominated, with 196GW currently operational. Today, another 25GW of gas-based generation is also used primarily for meeting base load demand, the minimum level of demand required on the electrical grid.

In the last 2-3 years the share of solar and wind generation, although low, has been increasing rapidly. This focus on the deployment of more variable renewable energy generation – a result of India’s transformation of the national electricity system to a more sustainable, lower cost, domestic generation – also brings additional load balancing pressures.

Image: NLDC, IEX, IEEFA

Energy prices through the spot market at the Indian Energy Exchange (IEX) move in tandem with demand. A comparison of hourly demand with prices through the Exchange on 3rd October 2018 revealed higher prices during peak hours. During evening peak hours, the price was much higher, indicating a shortage in supply.

IEEFA notes that the right tariff structure for generation is required to provide an incentive for the addition of more generating capacity to meet peak demand – known as peaking capacity, as well as incentivising the use of technology to drive demand response management to time-shift demand. Unfortunately, this strategy may not ensure cost recovery to generators supplying peaking power since the typical dispatch achieved at the Exchange would potentially be just 1-2 hours per day.

As the volume transacted at the Exchange is small (comprising just 7% of the total market share in October 2018), a better option would be a longer-term peaking capacity contract market (e.g. incentivising firm supply from new renewable energy projects supported by batteries, gas peakers and/or pumped hydro storage).

Although some Indian states already have peak prices that better reflect the cost of peaking power, the number of peaking tariffs introduced to date remains low. While these states have concentrated on distribution including the introduction of a time-of-day tariff, an alternative option for peak generation pricing to encourage peak power generation has yet to be introduced. As a result, India’s installed capacity is overwhelmingly dominated by inflexible mechanisms in demand and supply resulting in high costs to ‘consumers and a constraint on the ability of the grid to integrate more lower cost but variable renewable energy.

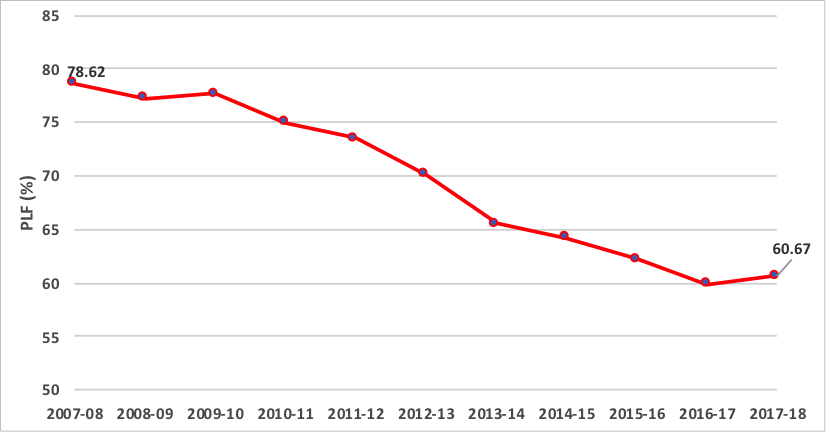

India is witnessing a decline in Plant Load Factors (PLFs) of coal-based thermal power plants, whereby the ratio of average power generated by the plants to the maximum power that could have been generated in a given period is near a decade low. This decline is due to over building, fuel shortages, water shortages, the poor financial health of generators and of distribution companies (DISCOMs). Cheaper renewable energy is also having an impact.

Image: CEA/IEEFA

A key issue is that out-dated coal plants are unable to ramp up or ramp down fast enough to respond to rapid changes in demand (see Figure 3), resulting in shortages during peak demand even while capacity is apparently available.

Timely ramping up and ramping down is only possible with greater grid interconnectivity plus flexible energy generation technologies, including hydro-electricity, pumped hydro storage, battery storage, peaking gas plants, as well as through demand side response leveraging ever-smarter grid systems.

IEEFA notes the longer-term market pricing for faster ramping and flexible generation to provide balancing capacity is missing in India.

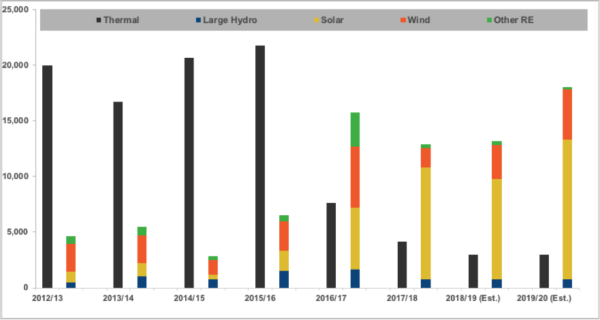

Current trends in capacity addition

India continues to progressively deploy renewable energy generation within its total energy generation portfolio, as shown in Figure 6, thereby exploiting the rapid, ongoing price reductions in renewable energy. Figure 7 shows IEEFA’s estimate of the overall electricity system mix in 2018/19.

Image: Central Electricity Authority, MNRE, IEEFA Estimates

| —- Capacity —- | — Generation — | Capacity | Increase | |||

| GW | % | TWh | % | Utilisation | GW yoy | |

| Coal-fired | 200.2 | 55.6% | 1,022.5 | 73.6% | 58.8% | 3.0 |

| Gas-fired | 24.9 | 6.9% | 54.5 | 3.9% | 25.0% | 0.0 |

| Diesel-fired | 0.8 | 0.2% | 1.8 | 0.1% | 25.0% | 0.0 |

| Large Hydro | 46.1 | 12.8% | 129.5 | 9.3% | 32.1% | 0.8 |

| Nuclear | 6.8 | 1.9% | 38.6 | 2.8% | 65.0% | 0.0 |

| Renewables | 81.4 | 22.6% | 143.1 | 10.3% | 21.7% | 12.1 |

| Total | 360.2 | 100% | 1,390.0 | 15.8 | ||

| Captive power | 51.4 | |||||

| Total | 411.6 | 114.3% | ||||

Figure 7: India’s electricity system capacity and generation by fuel type (2018/19). Source: Central Electricity Authority, MNRE, IEEFA Estimates.

From 22.6% of total installed on-grid capacity by March 2019 (10.3% of generation in 2018/19), and after an estimated 12.1GW of variable renewable energy capacity add-ons in 2018/19, IEEFA expects the share of renewable energy to progressively increase further, with likely materially stronger momentum beyond 2019.

Importantly, a greater off-take of renewable energy power in India requires grid strengthening, improved interstate transmission capacity, and ideally a stronger price signal for peaking power supply (such as time-of-day pricing) to reward fast ramping and flexible peak supply at least cost to producers, DISCOMs and consumers.

In India, currently grid operations are decentralised at regional and state level. The responsibility of load and generation balancing lies with the state. The price signals (time of day pricing) required to incentivise demand and supply side response is critical for renewable rich states, as load ramp up and down rates are much higher. Given the share of renewable energy will further increase in such states, a market needs to be developed that supports balancing capacity for improved flexing of the energy system.

India’s Central Electricity Regulatory Commission (CERC) is working towards reforming the energy markets in India with the proposal to change the market design to shift towards a more centralised national production and economic dispatch of electricity in a day ahead market. A real-time energy market with gate closure (one hour before the time of operation) to be introduced and the existing ancillary services framework to be further strengthened and graduated to a market based mechanism. Furthermore, once the hourly market matures, India could think of reducing gate closure time to 15 minutes. This could generate significant cost savings for the national system as a whole and further time of day pricing will provide right price signals for creation of balancing capacity to provide grid stability, subject to sufficient interstate grid transmission capacity be established.

Capacity for balancing renewable energy sources and grid frequency

With the increasing use of renewable energy, and the government’s stated objective to build a future power supply system primarily reliant on domestic renewable sources, India now needs energy sources for firming capacity and wider national and even international grid inter-connectivity. This would integrate increasing amounts of variable solar and wind generation and prevent frequency and voltage fluctuations that adversely affect grid stability.

India also needs additional storage in the form of batteries, wind-solar hybrid facilities, pumped hydro storage and gas peaking generators. Technological advancements and an increasing bias towards using storage solutions globally will help drive down prices. Further, it is expected that Concentrating Solar Power (CSP) technologies will also serve peak demand, once global deployments accelerate pushing down the costs lower.

India currently has 2.6GW of pumped hydro storage capacity installed and operating, with an additional 2.18GW under construction. In November 2018, the Japan International Cooperation Agency (JICA) agreed to loan $260m to the Government of India for the construction of the 1GW Turga pumped storage facility in West Bengal State, adding to the existing 0.9GW Purulia pumped storage facility commissioned in 2007/08.

The Turga facility would increase peak power generation capacity and strengthen the response capability, thereby improving the stability of the power supply. Similarly, pumped hydro facilities are being developed by THDC Ltd in Uttarakhand on the Tehri dam (1GW) by Odisha Hydro Power Corp at the Indravati multi-purpose reservoir in Odisha (600 megawatt (MW)), and by Tamil Nadu Generation and Distribution Corporation through the Kundah pumped storage hydro-electric project (500MW).

Further, in November 2018, the Indian government was reportedly looking at a proposal to set up a priority gas allocation mechanism for the peaking power generation sector, either by auctioning the gas or by allocating it to power projects by rotation for the next two financial years.

IEEFA notes that countries around the world are better able to replace fossil fuels with energy storage as the global storage market continues to pick up pace.

In November 2018, the California Public Utilities Commission approved four energy storage projects for Pacific Gas & Electric (PG&E) from Tesla to replace retiring gas peaking generators, as the cost of batteries is likely to be cheaper than continuing to operate the plants.

Similarly, after year of operation, Tesla’s 100MW/129MWh battery in Australia is touted be a preferred storage solution far superior to fossil fuel-powered plants, having driven down grid stabilisation costs for consumers by an estimated US$40m in its firsts year of operation.

Australia is now exploring a dramatic scaling up of investment in improved inter-state grid connectivity plus multiple pumped hydro storage projects (Snowy Hydro 2.0, plus Tasmania’s “Battery of the Nation”), additional grid-stabilising utility scale batteries, large scale residential battery storage rollout programs (a virtual power plant concept), as well as hybrid renewable energy infrastructure investments supported by enabling on-site battery storage.

In Japan, Mitsubishi Electric Corporation is providing energy storage systems capable of enabling about 600MW of wind turbines to be connected to the grid, thereby strengthening the grid with stable power supply.

IEEFA agrees with the suggestion by Mr Amithabh Kant, chief executive officer of the National Institution for Transforming India (NITI Aayog), that India should strive to take a lead in advanced battery manufacturing and electric vehicles. While India might have missed the opportunity for solar module manufacturing, batteries are a great ‘make in India’ prospect that could deliver economies of scale, locking in domestic investment and jobs in the provision of a lower cost, more reliable emission-free energy system of the future.

In December 2018, the Power Ministry mandated use of smart prepaid meters from April 2019, with the aim to reduce Aggregate Technical and Commercial (AT&C) losses and also to provide better demand response to reduce energy consumption during peak hours. The installation of smart meters should be coupled with the time of day tariff to achieve the desired results.

Building the market for firming capacity

India currently has a surplus of thermal capacity, limiting the need for additional thermal power except as a replacement for end-of-life plant closures. There is however a pressing need for fast ramping, firming capacity.

IEEFA notes that with its domestic energy security benefits, fast construction times, low externalities and low cost, deflationary nature, solar is definitely a key part of supplying India’s ongoing energy system growth. However, as India continues to deploy ever more variable renewable energy, without storage, the solar output has decreasing marginal value, entering at a time when it is less needed by the grid.

A report in December 2018 from The Energy & Resources Institute (TERI) suggests that until large scale flexibilization of the power system occurs through storage, demand response management, adaptability of the existing thermal fleet and large scale grid interconnection, increasing solar output will only incur increasing integration costs.

Peaking power supply price signals are also important. As discussed, the typical load curve for electricity in India demonstrates a significantly large peak in the evening and a relatively lower peak early morning. From the point of view of DISCOMs, average electricity demand is met using power plants with the lowest variable costs including wind, solar and hydro power. As demand increases during peak periods, generation plants with higher costs (thermal power) are dispatched. The longer-term market signal is not conducive nor sufficiently rewarding for such flexible, peaking power capacity.

A more progressive peaking power supply price signal is needed to appropriately reward flexible supply, be that fast ramping coal power, gas peakers, distributed as well as utility scale batteries, hydro electricity, pumped hydro storage, and demand response management. An ancillary service market with products like leakers-active and reactive power support, frequency regulation and ramp rates needs to be developed.

Planning for the lowest cost sources of peaking power can help achieve better capacity addition. This in turn should soften average power market prices and ensure adequate availability in capacity to meet peaking and reliability requirements.

In addition, a pricing and contractual mechanism needs to be developed to allow for ‘cost pass through’ to reduce the price a customer pays because of an increase in a company’s costs, while ensuring that projects are de-risked and hence bankable at least cost.

The ability to implement a peaking power supply price signal system is held back by systemic issues in India’s energy market design. Regulatory interventions are required such as introducing peak pricing mechanisms into the market (time-of-day generation tariff system) for peaking capacity with adequate commitment and dispatch to meet grid and market requirements.

India’s electricity pricing mechanism should also financially incentivise storage and firming capacity projects to allow uninterrupted power supply. Such innovations would be an extremely important contributing feature towards India’s economic growth, particularly while more low cost but variable renewable energy is commissioned in response to the government’s commitment towards addressing India’s growing energy security and emissions concerns.

About the authors

Tim Buckley (tbuckley@ieefa.org) is IEEFA’s director of energy finance studies, Australasia.

Anil Gupta (anil.gupta@enerfra.com) is Director with Enerfra Services Pvt Ltd.

Vibhuti Garg (vgarg@ieefa.org) is an IEEFA energy economist.

Kashish Shah (kshah@ieefa.org) is an IEEFA research associate.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.