In January 2019, Government of Andhra Pradesh issued a new solar policy superseding the solar policy issued in 2015. The state aims to add 5 GW of solar power capacity in the next five years, with solar park capacity addition target increased to 4 GW from 2.5 GW. The major change is the state’s abrupt pull back on open access.

The state has decided to withdraw almost all incentives available to open access solar: Electricity duty and cross subsidy surcharge (CSS) are no longer exempted. Distribution losses are also not exempted for projects injecting power at 33 kV or below. Wheeling and transmission charges are exempted for connection to national transmission grid, but exemption is withdrawn for intra-state open access projects. Purchase of unutilized banked energy is capped at 10% of the total banked energy during the year, price is reduced to 50% (100% earlier) of average pooled purchase cost.

Other relatively minor changes include support of the state nodal agency, Non-conventional Energy Development Corporation of Andhra Pradesh Limited (NEDCAP), in acquiring government land for project developers. The government also proposes to give preference for power purchase, evacuation connectivity and energy banking to projects developed by local solar equipment manufacturers and related ancillaries.

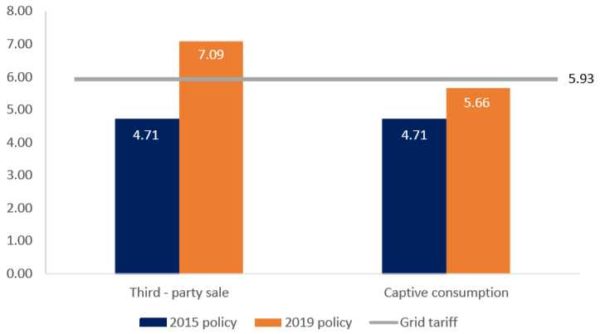

Under the earlier policy proposed to be valid until March 2020, CSS was exempted for 5 years and electricity duty, transmission and wheeling charges and distribution losses were exempted for 10 years for projects connected at 33kV or below. The new policy makes the state unattractive for open access. It increases landed cost of solar power for industrial consumers by INR 2.38/kWh and INR 0.95/kWh for third-party sale and captive consumption, respectively.

Bridge To India

Andhra Pradesh was considered a high potential state for open access due to its attractive policy regime, relatively easy land availability and strong solar eco-system. Owing to these advantages, Bridge to India had estimated open access solar capacity in the state to increase from 154 MW in December 2018 to about 500 MW by March 2022. However, that appears highly unlikely under the terms of new policy.

The policy reversal is clearly to appease state discoms, who continue to struggle financially despite support from UDAY scheme (Ujjwal Discom Assurance Yojana). In 2017, Madhya Pradesh withdrew most incentives for open access solar projects, followed by Karnataka in 2018. Haryana is still struggling to implement the policy first announced in 2016 and has recently issued an order withdrawing exemptions of open access charges for third-party sale projects. As Bridge To India maintained in its recent report on open access solar, the market is being held back by frequent policy challenges and negative attitude of discoms and other state agencies.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.