From the June edition of pv magazine

For many years, PV cell and module technology was pretty boring. You would go to a trade show, and it would largely be the same plain vanilla multi- and mono silicon you had seen the year before. A few companies like SunPower, Panasonic and LG had different technologies, but these had been around for years or even decades with no major changes.

And while it was possible to see technologies like metal wrap-through on display, very few companies were actually making these at commercial scale. Instead, the greatest technical innovation that most companies undertook was to incorporate passivated emitter and rear cell (PERC) technology into their cell lines.

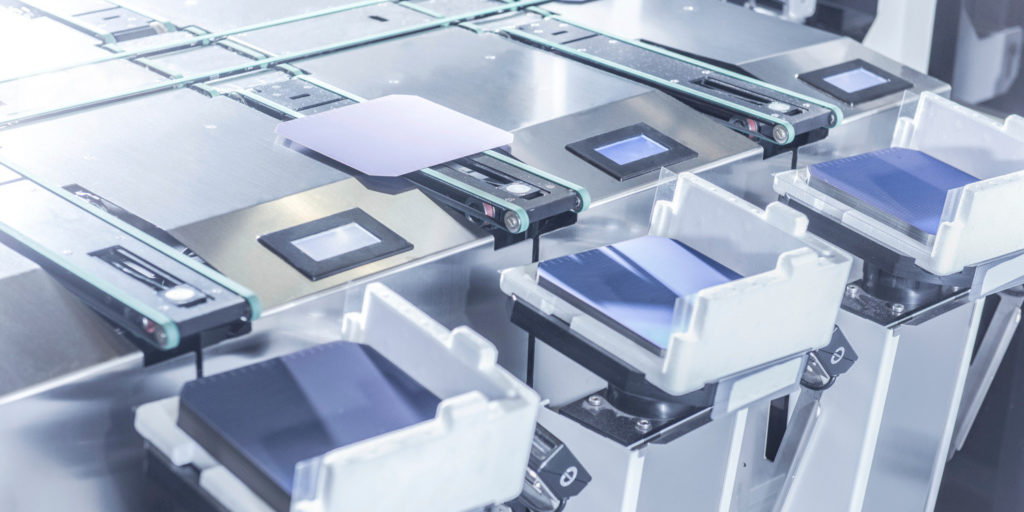

But over the last year or so, all of that has changed. There has been an explosion of new cell and module technologies, including half-cut cells, bifacial cells and modules, new heterojunction designs, and even shingled cells – with at times two or more innovations combined into a single product. And these are no longer only demonstration modules, they are instead being produced at multi-hundred megawatt to gigawatt-scale.

Along with this comes many questions. Do these technologies work? Will they deliver the gains that are promised? Will they hold up over a 25 year timeframe? What risks are developers taking by deploying them, and are they worth the extra cost?

We won’t be able to answer all of those questions in this article, but we can give you an overview of some of the more compelling designs, as well as going over some of the issues around adopting these technologies.

Half-cut

Resistance losses are something that all solar cell and module makers have to deal with. The further current travels on a cell, the greater loss it incurs. So why not cut the cells into smaller pieces, reducing the resistance loss accordingly, and gain a few watts? To make it simple, why not cut them in half?

Several manufacturers have tried out this idea. Mitsubishi Electric made modules based on half-cut cells for many years, but the company did not keep pace with its larger competitors – particularly Chinese companies – over the last decade. The idea was also adopted by SolarWorld, but the real breakthrough for half-cut cells was when REC Group launched its TwinPeak series in 2014.

The TwinPeak featured not only half-cut cells, but also twin junction boxes, essentially making two solar modules in one. Thanks to integrating PERC the product really pushed the limits of what could be accomplished with multicrystalline silicon, achieving efficiencies of up to 18% and power ratings of up to 300 W in the same format as a standard 60 cell module.

In recent years multiple manufacturers have deployed half-cut designs. According to PV InfoLink, 18 GW of half-cut module capacity was online last year, and this will nearly double to 30 GW this year.

PV Evolution Labs CEO Jenya Meydbray says that one of the reasons for the increased adoption is how little of an impact switching to half-cut has on manufacturing operations. “It’s not a tremendously complicated modification,” Meydbray tells pv magazine. “You have a machine that dices your cell and you have to modify your tabber-stringers. It’s not trivial, but it’s not new technology or anything – and you get a pretty good bump in output.”

Meydbray says that while he hasn’t seen apples-to-apples comparisons of half-cut versus full-cell designs, modules with split cells are roughly one to two bins higher than full-size cells, and he estimates a 5 W gain for a 60 cell module.

The latest standard bearer of the half-cut cell is Hanwha Q Cells, which unveiled its Q.Peak Duo G6 in April, a variation of the Q.Peak Duo G5 with larger wafers. Like the G5, the G6 features monocrystalline PERC cells, and as such offers an efficiency of up to 19.9%, and power ratings as high as 420 watts. It also is being produced on a substantial scale, with Hanwha Q Cells’ 1.7 GW factory in the U.S. state of Georgia dedicated to producing the G6.

Bifacial

While half-cut is probably the most well established of the new cell and module designs, bifacial is generating the most excitement. Many of the world’s largest PV module makers are producing a bifacial product, including Jinko, Trina, and of course Longi, which has championed bifacial more than any other company.

And as these products are being made, they are also being deployed at a fairly significant scale for an emerging technology, with Longi stating that it alone has deployed 1 GW of bifacial modules already, and that it expects to deploy another gigawatt by the end of this year.

The allure of bifacial is simple: the extra output of the back side of the cell, which manufacturers say is best realized when combined with single-axis tracking. But it is not at all clear how much gain this provides. The extra output of bifacial cells and modules depends on the surface that is reflecting light on the back side of the panel, and this quantity of reflectance is called the albedo.

The albedos of different surfaces vary widely, which means that measures of additional gain can vary as well. And while the IEC has released a technical specification designating practices for measurement of bifacial cells, this does not yet have the global consensus to become a standard.

So in the interim, manufacturers are reaching their own conclusions, and there is no real way to compare various claims. Furthermore, this is no agreement about whether the extra gain from the backside should be expressed in terms of increased efficiency/power rating (watts) or energy yield (watt-hours).

“I’ve seen data sheets in the past that have the nameplate power already juiced up,” notes PVEL’s Meydbray. “You can call this additional efficiency, or you can get up to 25% more energy yield – but you can’t get both.” He argues that no manufacturer should be claiming an increase in power, but instead only in energy yield.

And no one seems to know for sure how much capacity to produce bifacial modules is currently online. “Since bifacial doesn’t need special equipment, just a change in the module bill of materials and a change in the cell from single to double side, it is hard to say how much capacity there is,” explains Corrine Lin, Chief Analyst at PV InfoLink.

Longi claims to have the largest capacity of mono-PERC modules in the world, with between 9 and 11 GW online currently and 16 GW expected by the end of the year. Among the products it is making is its LR4-72HBD module, which was launched at Intersolar Europe as Longi’s latest module to combine bifacial and half-cut technologies. The new large-format module offers power ratings from 415-435 W, with efficiencies as high as 19.4%, and Longi has produced champion modules rated at more than 450 W.

Shingled cell

In any piece of equipment, the connections are often the weak points. And with a race to squeeze more watts off of rooftops, output often commands a premium. The next innovation in the cell and module space addresses both of these issues, by eliminating nearly all of the “white space” on the standard module, and by reinventing the way that cells are connected.

Compared to half-cut and bifacial modules, shingled solar cells represent a bigger departure from conventional crystalline silicon module technology. They require the same sort of slicing that is done with half-cut cells, but in place of the ribbons and solder connecting cells, the overlapping cells are connected with electrically conductive adhesive (ECA), which is a sort of glue with metal beads embedded in it.

PVEL’s Jenya Meydbray notes that addressing this connection offers the potential for more durable cells. “Solder joints tend to be the Achilles heel of solar reliability,” he explains.

However, ECA has its own set of challenges. “The material set is far more complex, and we have less experience with it in the world,” explains Meydbray, noting the difference from the generations of global experience with solder that can be drawn upon.

He notes that this means very different results depending on the ECA, with one danger being that if it is too hard after drying and curing, it can crack under thermal cycling. “I don’t want to say that it can’t be done well, but it is more novel,” states Meydbray.

But with the “additional real estate” that can be gained from eliminating both busbars and the space between cells, manufacturers are taking on this challenge. Solaria has been making shingle-cell modules since 2016, and has achieved very high efficiencies with its PowerXT series.

But it is SunPower that brought shingled cell technology into the big time, with its P-Series based on technology it acquired with Cogenra. SunPower has made 1.5 GW of P-Series product since 2019, and the company’s new P-19-410 based on mono cells offers efficiencies up to 19.9%. SunPower stresses that by using a shingled solar cell it not only gets higher energy output from the same area, but also superior reliability, and the panels are backed by the company’s combined 25 year power and product warranty.

And shingled cells are catching on with other manufacturers as well. In 2018 PV InfoLink estimates that there was only 4.5 GW of shingle cell module capacity globally, but expects this to nearly triple to 12 GW by the end of this year.

Heterojunction

The final significant cell and module innovation we see cropping up today is perhaps the oldest of them all. Panasonic first began mass production of cells and modules based on a layer of crystalline silicon sandwiched between two layers of amorphous silicon, dubbed heterojunction intrinsic thin film (HIT) 22 years ago in 1997.

Silicon heterojunction designs like HIT offer the same advantages of other heterojunction designs: the ability to capture more of the energy from sunlight, as amorphous silicon absorbs different wavelengths compared to crystalline silicon.

But despite Panasonic’s success with HIT and the ability to buy off-the-shelf heterojunction lines from Swiss tool maker Meyer Burger, few companies have scaled silicon heterojunction to mass production. While silicon heterojunction cells require fewer process steps compared to standard crystalline silicon cell production and a similar module assembly, the process is not easy to master.

One of the more promising companies in this space was Silevo, which looked poised to break into gigawatt-scale production through its partnership with SolarCity. But after Tesla bought the residential PV company, Silevo was pushed aside in favor of Tesla’s battery manufacturing partner Panasonic.

However, heterojunction is breaking into the big time again with REC Group’s recent unveiling of its new 380 watt, 60 cell heterojunction module at Intersolar Europe. Using tools ordered from Meyer Burger, REC is launching with 600 MW of projected annual output, set to come online in the fourth quarter of this year.

And while pv magazine has not seen the new module at time of publication, press materials mention “advanced connection technology,” which is likely to mean Meyer Burger’s SmartWire copper wire interconnection technology, which was included in a 600 MW order from Meyer Burger last December.

As such, this will be a radical departure from mainstream cell and module technologies. Nor is it the only such heterojunction design out there, and PV InfoLink estimates that heterojunction module capacity will increase from 3.7 GW in 2018 to 5.2 GW in 2019.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hetrojuncation module more information required comparision other cell technology