Mumbai-based Sterling & Wilson Solar has launched construction on a 200 MW solar project in Australia. The project is the first in the EPC’s Australian pipeline to come to fruition as it seeks to establish a footprint in the market.

Present in Australia since 2015, Sterling and Wilson has been offering diesel generators and cogeneration solutions through its office in Perth. In 2017, the company opened an office in Brisbane looking to tap the vast potential of Australia’s solar market. Soon after, the EPC unveiled plans to construct 500 MW in the coming three years calculating at the time these projects would attract an investment of $600 million.

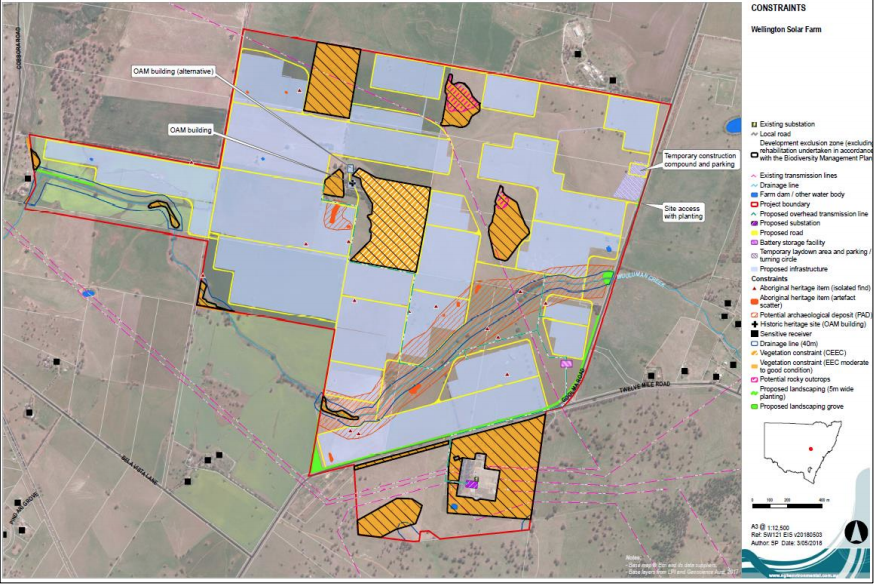

The 200 MW DC solar project (174 MW AC) is situated near Wellington in New South Wales is Sterling & Wilson’s first solar job in Australia. Developed by Lightsource BP, the solar farm will showcase next-generation Canadian Solar bifacial panels, alongside Array Technologies DuraTrack HZ v3 single-axis solar trackers. It is planned to be commissioned by December 2020 and once operational, the plant will produce is expected to produce approximately 435,000 MWh of clean electricity a year, enough energy to power approximately 72,500 homes and cut carbon emissions by 350,000 tonnes.

Noting that Australia is “one of the most promising markets for solar”, Sterling & Wilson Solar CEO, Bikesh Ogra said: “We had been following the market for over a few years and wanted to get in at the right time with a right project.” According to him, the EPC will seek to leverage its recent acquisition of Western Australia-based contracting firm GCo Solar to bring its best practices to the Australian market.

In August, Sterling & Wilson Solar became the first Indian solar company to go public. It raised Rs 29 billion ($597 million) as against the expected Rs 31.25 billion ($638 million), with the Initial Public Offering’s institutional portion oversubscribed. However, the company’s shares plummeted in November after the company’s promoters, Shapoorji Pallonji and Co. Pvt. Ltd and Khurshed Y. Daruvala, failed to honour their IPO commitments and sought more time to repay loans citing unforeseen reasons including a liquidity crisis.

For Lightsource BP, the Wellington farm was its first utility-scale solar project in Australia to secure finance. In October, the British-headquartered solar arm of oil major BP agreed on a senior debt facility with Dutch bank ING and Export Development Canada to fund the project. Namely, the project is the largest single plant to be financed by Lightsource BP to date and one of the first ones in Australia to use bifacial solar panels at the utility-scale.

Most of the project output is contracted by Snowy Hydro via a 15-year power purchase agreement. The offtake deal was locked in as part of a massively oversubscribed 888 MW renewable energy tender invited by the government-owned retailer last year. At the time, Snowy Hydro said that it would be able to offer firm supply contracts at less than $70/MWh, which undercut the wholesale price of electricity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.