India’s solar sector faces a significantly large brunt of coronavirus (Covid-19) pandemic much like patients with existing comorbidities. The sector is already suffering from issues like payment delays, change-in-law payments, power purchase agreement (PPA) renegotiations, safeguard duty and lack of clarity over goods and services tax (GST). Covid-19 outbreak further threatens project execution schedules.

Covid-19 has become pandemic within no time and has put a halt to all construction activities and import of modules, inverters, spares and raw materials from China. Solar projects with domestic modules also stand to get impacted as India imports a significant part of wafer, cell, and other raw material for modules from China.

The challenges are exacerbated with labour leaving the sites, states asking for shutdowns and social distancing, preventive measures on sites against spread, vehicle entry restrictions at state boundaries, forex fluctuations, etc.

In order to steer through these difficult times, coercive action is required from the government to protect the solar sector. This article talks about the areas the government needs to address both immediately and in the long run to help the ailing solar industry in the country.

Liquidity

Payment dues (including Change-in-law). For the last two years there has been sever financial crunch across the renewable energy sector, which is a capital-intensive industry where availability of liquidity is important. Tariff payments to the tune of around US$ 2 billion (over Rs 12,000 crore) are pending with utilities. This doesn’t include the change-in-law compensations for GST and safeguard duty, dues for which alone constitute another Rs 2000 crore.

Further payment delays can drive non-performing assets (NPAs) in solar firms. In order to help wind and solar developers maintain business continuity, the Ministry of New and Renewable Energy (MNRE) should direct the Solar Energy Corporation of India (SECI) and NTPC to consider making immediate payments to them.

At State level, governments should consider giving the Discoms a capital injection to pay power generating companies. Further, to improve liquidity, they should also direct Discoms to pay safeguard duty/GST dues to all RE generators.

Forecasting & Deviation Settlement Mechanism. Forecasting and Scheduling activities depend on a lot of allied activities for delivering accurate forecasts. Under the current lockdown, the allied activities are either completely shut or will be working with skeletal systems that are impacting the overall forecast quality.

Regional load despatch centres (RLDCs) and state load despatch centres (SLDCs) should consider suspending penalties on generators arising out of implementation of the Forecasting and Scheduling Regulations during the lockdown period.

Billing and invoicing. Another disguised issue related to liquidity is billing and invoicing.

There are two parts to invoicing: Joint meter reading (JMR) and invoicing. First, JMR is taken and then the generator raises a physical invoice on the basis of quantum of energy in JMR.

In Covid-19 times when almost all routine operations throughout the country have critically suffered (some have come to a complete standstill owing to the national lockdown), it would be very difficult to provide physical copies of invoices even as JMR under the current situation would not be possible.

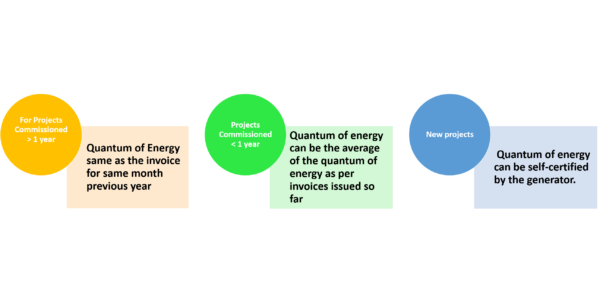

In order to safeguard the financial viability of the projects and the renewable industry at large, a simple mechanism for JMR can be followed based on the timeline of commissioning.

Image: NSEFI

In cases where JMR is not possible for any reason, including lack of availability of manpower, the quantum of energy for which invoicing should be done, can be assessed as follow:

- For projects that were commissioned more than 12 months ago, the quantum of energy consumed can be the same as in the invoice of the same month in the previous year.

- For projects commissioned within the last 12 months, the quantum of energy consumed can be the average of the quantum of energy as per invoices issued so far.

- For new projects, the quantum of energy can be self-certified by the generator.

When the situation returns to normal, any deviation could be reconciled between the procurer and the generator after conducting JMRs.

Open access banking. Many developers also supply power directly to various industries under open access/third party/captive mode. The capacity under such arrangement is in the range of 7000 MW. During the ongoing lockdown across the country, various industries, malls etc are either shut down or operating at minimal loads. However, solar and wind power plants continue to inject power in the grid and there is a possibility that the industries are not in a position to off-take the power. Under such scenario, the power injected by solar and wind developers must be banked in the grid which can be utilised by industries later on when the situation normalises.

All states should allow banking of such power with relaxation of banking norms—the banking deadline could be extended by another 6 months which should benefit all the group captive and open access customers.

Extending validity of compliances and licenses

Many businesses might be approaching the expiry of various licenses, approvals, no-objection certificates (NOCs) and clearances. These approvals/licenses range from inspection related approvals under various Labor Acts, Change of Land Use License, Factories Act License, Shops & Establishment Act License, among others—processing which requires massive paperwork, administrative support, time and payment of annual fee.

It would be wise for the government to come out with guidelines for all government departments whereby they enhance validity of licenses, approvals and NoCs up to September 2020 without any requirement of renewal applications or payment of associated statutory fees.

ALMM and safeguard duty

As per MNRE notification dated 02.01.2019, all the module and cells manufacturers were required to apply and get enlisted with the Approved List of Models and Manufacturers (ALMM) before March 31, 2020.

Additionally, DGTR notification dated 03.03.2020 has indicated initiation of review investigation into continued imposition of safeguard duty on imports of “solar Cells whether or not assembled in modules or panels” into India.

Keeping in view the ongoing crisis, the government should consider extending the ALMM enlistment date by one year, i.e., until March 31, 2021. The Directorate General of Trade Remedies (DGTR) should also consider suspending the review investigation at least until June 2020.

Moratorium on loans and avoiding NPA status

The Reserve Bank of India (RBI) should grant a moratorium on interest payments. Additionally, these payments could be deferred from a monthly cadence to half yearly cadence for the next 12 months to enable some time for the industry to get their business operations on track and avoid becoming NPAs under the current RBI guidelines.

Considering the Covid-19 scenario, the government should extend the timeline for the payment of debt service from 90 days to a minimum of 180 days. This will automatically provide additional working capital for businesses. Further, rating agencies should be advised not to downgrade ratings because of this extension. CIBIL should also remain intact.

Covid -19 Bridge Loan

As Covid-19 can impact short-term liquidity due to receivable position, the RBI can instruct public-sector banks or other financial institutions to come up with a plausible Covid-19 bridge loan facility to meet these short-term requirements. This loan tenure can be 1-2 years with a moratorium of 6 months. Banks should refrain from rejecting/non-disbursing loans in anticipation of project delays due to the ongoing condition.

Additionally, RBI should consider opening a window with relaxed external commercial borrowing (ECB) restrictions w.r.t end use and minimum tenor so that companies can borrow from any markets as the domestic debt markets are struggling and the Rupee is depreciating. The ECB caps should also be relaxed as overall yield curves are severally distorted.

Apart from this, the Finance Ministry can also look into removal of Dividend Distribution Tax and leverage caps on INVIT for renewable projects so that a new set of investors which are yield focused could be tapped.

The views expressed in this article are solely of the author and in no way reflect that of NSEFI

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.