From pv magazine 11/2020

Few corporate sustainability reports today fail to mention the circular economy. While the initiative first caught the public’s attention through consumer goods and the plastic waste crisis, virtually every industry is now creating goals and targets for materials use. It is only fitting that the companies driving the energy transition have a role in this circular transition.

However, recycling services for the wind and solar sectors have been slow to develop. For most, it is a problem that feels too far away, while there is so much to worry about in the here and now. Six conclusions from a BloombergNEF report on PV recycling shed light on the status of the industry and how circularity is not always a straightforward path.

Small fraction

Around 26,000 tons of PV panels will end up as waste this year. This is only a fraction of global electronics waste, which amounted to 54 million tons in 2019. Solar panels are made to last 25 to 30 years, so most of the panels produced are still out in the field, generating electricity. Modules that end up as waste today are most often damaged due to natural disasters or have degraded prematurely due to faults in the manufacturing process. Occasionally modules are scrapped after being taken out of the field to be replaced with newer, more efficient ones.

Waste volumes will rise significantly from 2030, when larger volumes start to be decommissioned. Germany and Japan will be the first countries to deal with large amounts of solar waste, as they have the oldest installed fleet. By 2040, a wave of solar capacity in Japan, China and India will be decommissioned, and the United States will also see larger volumes. But even in 2050, BloombergNEF estimates annual PV waste will amount to 10 million metric tons globally. It is believed these are manageable volumes, considering how much electronics waste is produced today.

Glass recycling

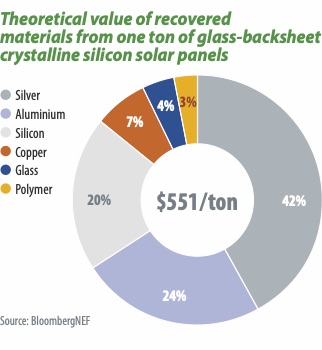

A solar PV panel is mostly glass by weight. While glass is in theory easily recyclable, in PV panels it is contaminated with metals, meaning the recycled glass cannot be used in food-contact applications like bottles. This cuts out a large market for recycled glass and lowers its value. We estimate that 76% of the weight of a glass-backsheet panel is glass, which represents only 4% of the theoretically recoverable value.

Many discarded panels today are stripped of their aluminum frame and junction box and then taken to landfill. Recyclers do not take them for free and the landfill fee is usually the cheapest option. In Europe, where solar panel recycling is mandatory, it is mostly glass recyclers who do the job. For them, a solar panel is a very similar product to a car window or an electric hob for cooking. Glass recycling firms collect panels until they have a reasonable volume, and then use an existing recycling line for one or two days to process all the panels they have stockpiled. The process is called “mechanical recycling.” Essentially, the solar panels are crushed and ground into particles, which tend to be of different sizes by composition. These particles are then sieved or otherwise sorted by material size. The process is relatively low-cost; glass and metal recyclers can do it with existing machines and infrastructure. Around 85% of the materials in a PV panel can be recovered in this way.

Circular manufacturing

Material recovery

Although mechanical recycling is efficient in recovering the bulk of materials in a solar PV panel, it cannot recover the most valuable materials, like silver and silicon. These materials represent around 62% of the value that could theoretically be recovered from a crystalline silicon module, assuming current scrap prices for these materials.

It is, however, possible to recover these valuable materials, including silver. The main challenge is removing the encapsulant material without contaminating or damaging other materials. There are several lab-proven options. One way to remove the encapsulant material in a “clean” way is through thermal recycling. In this process, the module is heated in a furnace to evaporate the encapsulant. The glass can then be recovered without any damage. In further steps, wafers, copper and silver can be recovered without any impurities using chemical recycling, which uses chemical reactions and solvents to separate the materials. However, these processes are expensive, energy intensive (thermal recycling requires temperatures of 250 C to 500 C) and hard to scale, as chemical treatments can take up to a day.

Essentially, recycling solar panels is a trade-off between cost and material recovery. It is relatively easy to recycle the bulk of the panel, but you will always recover lower-value materials and end with 10-15% waste. It is possible to recover more and purer materials, but this comes at great cost.

One further challenge is, ironically, the rate at which the industry is reducing its use of valuable materials. An annual BloombergNEF survey of materials use (Cells and Modules 2020: Make It Bigger, If Not Better, August 19, 2020) found that an average solar cell in 2019 used 87 mg of front silver paste and 25 mg of back silver paste, compared with a cell in 2016 using 117 mg of front silver and 32 mg of back silver. This means that modern solar panels have a much lower theoretical recovered value than those made even four years ago – although of course this is no reason to curtail increasing material efficiency.

Circularity options

In theory, glass sheets recovered through thermal recycling can be reused in new solar PV modules. Recovered wafers that are purified into solar-grade silicon could also be reused. However, the industry is far from implementing this in practice. Thermal recycling does not happen at scale yet – neither does purifying recovered wafers.

Even if these processes were commercially established, there would be many challenges to achieving this kind of circularity. Reuse and remanufacturing business models rely on standardization. However, in the PV industry, the trend is currently toward different cell and module architectures, seeking a unique selling point.

Single module brands can offer modules made with different wafer sizes, different numbers of busbars, half-cut cells and glass-glass or glass-backsheet models. Over the last decade, the standard cell size has changed from 156 mm to various larger sizes. Modern manufacturers have options giving side length of 157 mm or 166 mm. Some are now trialing a size up with 182 mm and even 210 mm.

Old wafers and glass sheets do not fit the formats of today’s module dimensions, and the products manufactured today may well use very different specifications to those that will be manufactured 30 years from now. Both glass sheets and wafers have also become thinner, and small cracks that can develop at the end of a wafer’s lifetime would prevent it from being purified.

The final option is giving panels a second life, by selling decommissioned modules as second-hand, or refurbishing broken modules. However, BloombergNEF does not believe this will be a popular option. Second-hand solar panels will have a shorter lifetime and lower efficiency than new modules and must, therefore, be priced even lower than new modules, which are becoming extremely cheap. For refurbished panels it is even harder to compete, as the refurbishment comes at an extra cost.

Policy, not economics

The small scale of solar PV waste, even after 30 years of growth, combined with shrinking precious metals content, will make the economics of PV recycling quite challenging. Despite this, solar manufacturers and waste managers are already investigating recycling services. This is because policymakers are sending signals that if the solar PV recycling market does not develop on its own, they will give it a push.

The European Union already holds PV manufacturers responsible for the waste their products create, and many other countries could follow suit. Legislation at the state level in the United States is already emerging. Japan is taking a different route, holding project owners responsible for waste disposal. Project owners will be forced to pay 5% of capex into a fund for decommissioning from July 2022 onward. In practice, this means that for the last 10 years of the feed-in tariff (FIT) period, part of the income will be set apart in an external fund. Owners can access the fund only at the end of the FIT period, upon decommissioning of the project.

Electronic solutions

Legislation for PV panel waste could look a lot like that introduced for other electronic waste around a decade ago. Extended producer responsibility fees make manufacturers pay for their waste in advance and create a fund for recycling. Landfill bans force waste managers to divert the waste properly, rather than just accepting tipping fees as the cost of doing business. Policy will play an especially important role in the developing world, where BloombergNEF expects to see significant solar build-out in the coming years, and where there is little formal waste disposal infrastructure. PV waste is a problem worth working on, but it is still a manageable part of the huge challenge of transforming our civilization to one that is sustainable in the long term.

Cecilia L’Ecluse & Julia Attwood

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

This article is very appropriate as it tries to not repeat mankinds mistakes of the past…. mostly solid waste… openly produced in Fossil, Nuclear and Industrial Facilities.

As the “Solar Industry” attempts to increase the output and other performance related objectives, newer and more exotic materials and solutions are being utilized.

As there is NO WASTE PENALTY in the Costing of Solar Panels / Products EVEN TODAY (50 years back when I went to Engineering School… there was NOT A WORD about the “rear end” of Technology…. Waste a

or Pollution …. Electrostatic Precipitators and Bag Houses had just started and the “Love Canal” Environmental Disaster in Buffalo, NY had yet to become public)… so Component and Equipment Designers and Organizations must be fully aware and fully include “Waste Problems/Costs” during the inception stage itself…. and not “pass the buck” to the next guy in the long chain from Birth… Production … Usage .. to “After Life” Waste/Recycling…

I say follow the KISS (Keep It Simple Sir) as far as possible to better manage and facilitate the “After-Life” Challenges of their products and do not leave a legacy of Waste, Pollution and Health Hazards for Man and his Home…. Earth…. like the 100,000+ year Radioactive Nuclear Waste from Nuclear Facilities today…

In India we use all such recyclables for free. Collection is the cost. But people are making money. It’s not a regularised issue.