Indian solar records don’t last long these days. After an unprecedented winning auction bid of 2 rupees per kilowatt-hour in November, a new record low was set in December of INR1.99/kWh.

The fall in price has been attributed to structural and state-specific factors, including a reduction in PV module costs globally, lower financing costs, and import tax exemption on panels. But another crucial driver of lower bids has been the adoption of advanced PV system designs, specifically bifacial modules plus trackers.

Successfully utilizing this new technology could be the make-or-break factor in the profitability of ultra-low winning bids in India. In the first round of record-low bids in November, there was a significant gap between the 2.3+ rupee losing bids and the winning ones at INR 2 and below. We can confidently assume that the winning bids made use of this more advanced technology.

For those that didn’t win – and with new requirements for sophisticated hybrid projects on the horizon – it may be time to go back to the drawing board to finesse designs and build in new technologies that are optimized for maximum production.

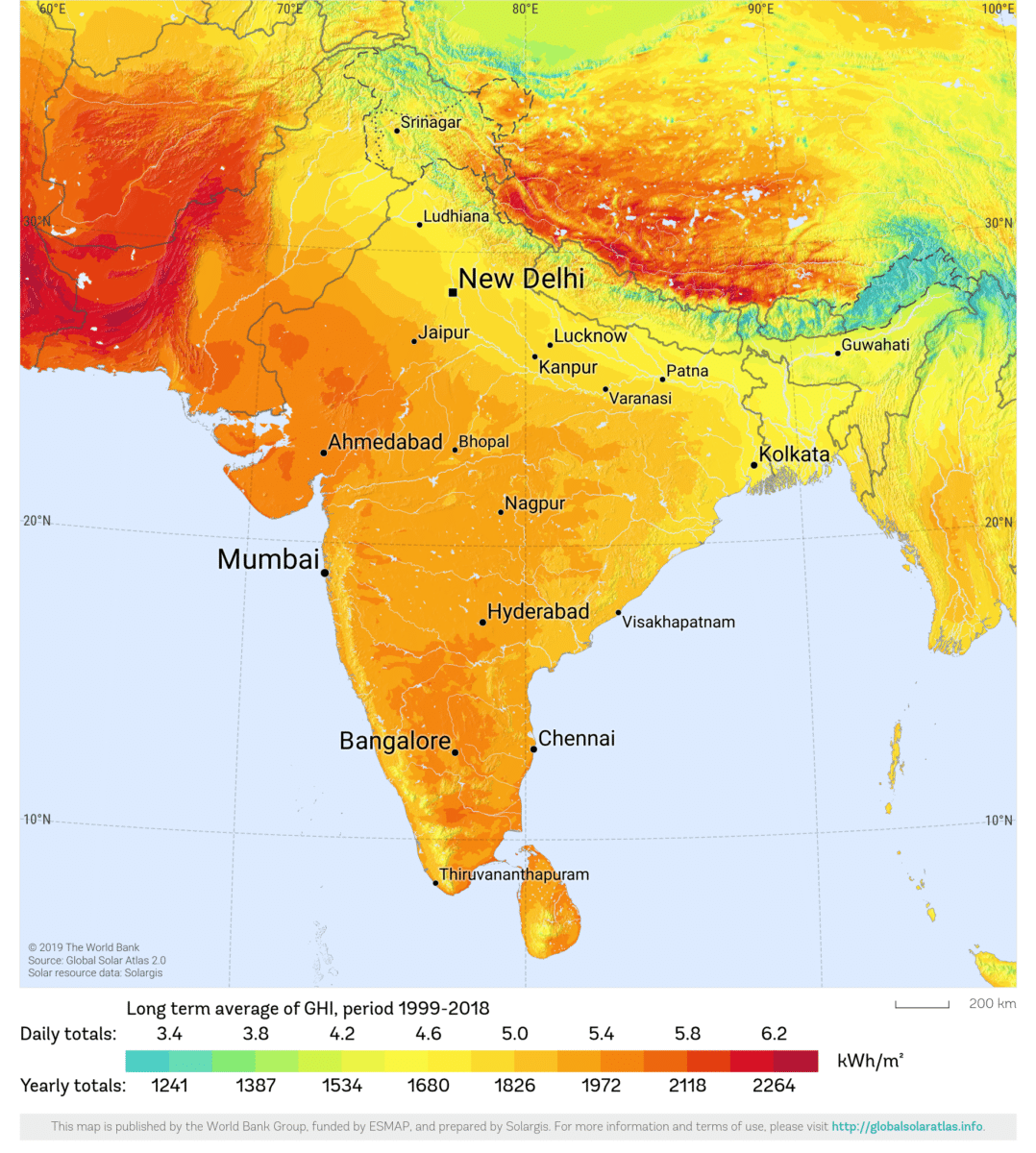

But technology is only as good as the resource that underpins its performance. India is poised to take great leaps forward in project design, but there are still significant shortfalls in the way that the market approaches resource risk management – and its use of accurate data to inform crucial development decisions.

For developers to close the emerging gap as the market becomes more competitive – and, crucially, build projects that perform to investors’ expectations in the long term – they need to not only develop better understanding of the factors influencing project performance but also take steps to adopt advances made in other established solar markets worldwide in the use of solar data.

Understanding the ROI of solar data

Before the Indian market can do so, the industry must build its understanding of the financial gains that using high-resolution resource data can create throughout the project design, financing and operation stages.

Historically, the Indian solar market has not performed at the same level of due diligence as other established international markets when it comes to data standards. This has led to under-investment in good quality data compared to Europe or America.

The problem isn’t a lack of understanding on the ground. Engineering teams working on solar projects in India are often well aware of the value of good data. But they may find it difficult to make a case for more granular, accurate solar resource data to their procurement and finance departments, as the return on investment isn’t always fully understood.

When a 1% reduction on resource risks can increase return on equity by approximately 5% for the investor, however, the need for investment into reliable solar data is clear. As projects increase in complexity, the gap between developers who successfully use data, and those who do not, will increase accordingly.

Enabling new technology

Technology has been a key driver of recent record-low bids. The most successful developers will therefore look to boost the effectiveness of technology using data.

In more mature solar markets such as the US, the uptake of trackers is around 50%. In India, this number is between 5-10%. As costs reduce for tracking manufacturers, the levelized cost of electricity (LCOE) for projects using trackers will also fall, and use of the technology will increase. However, the largest gains come from combining bifacial modules and trackers.

Indian solar is primed for a technology revolution in this area, but there is one crucial issue that must be addressed first: albedo data. Albedo data is essential when assessing the productive potential of a bifacial project. Many commonly used datasets currently fail to capture this metric accurately, making investment in high-quality data vital as the sector looks to capitalize on advances in the design of PV systems.

Bidding with confidence

Growing competition in the Indian solar market has led to scrutiny of data quality, especially for large-scale sites. For 100MW+ projects, reverse auctions are the typical pricing mechanism. Developers are guided by their equity ROI (return on investment) targets, which limits how low a bid they can make.

As the latest auctions have shown, the market is competitive enough that half a percentage difference in the pre-bid calculation could be a deciding factor. There is often no room for error – if developers don’t perform the yield assessment accurately before the bid is made, problems could arise when the financial modelling is scrutinized in more depth at the project’s financial close.

Accurate solar data allows developers to bid with confidence, as they can reduce the uncertainty around their project performance. The leading solar datasets can reduce resource uncertainty from 10% to 5%, increasing investor trust and allowing companies to bid lower without undue risk.

Leveraging ground measurements

Accurate satellite data can give solar developers important information about how much energy they can produce at a given site. However, for those looking to reduce risk to a minimum, it’s critical to support this by taking high-quality measurements on the ground to corroborate satellite readings.

Using ground measurements is rare in Indian solar, but it could be a key part of driving more aggressive bids in the future. Those who take more sophisticated approaches to on-site measurement will find themselves with a competitive advantage, as they will underpin their financial modeling with validated resource data. Typically, using 12+ months of good-quality ground measurements can reduce resource uncertainty by 1% or more, and thus increase equity ROI by 4-5%.

As the solar sector continues to grow, there is also increasing opportunity to make use of data taken from assets already in operation nearby. Before that happens, the industry must recognize the value of backing up satellite-based solar data with on-site measurements.

Increasing climate resilience

Even as competition in Indian solar ramps up, climate risks are increasing, and investing in data to better understand long-term variability is now a prerequisite for reliable estimates.

The increasing frequency and severity of extreme weather events such as droughts, storms and heatwaves mean that solar data needs to be accurate and up to date. It is also vital to include meteorological measurements such as wind speeds and precipitation levels to ensure that long-term estimates of project yields are accurate, especially as India’s monsoon season starts to see changes driven by climate change.

Investment in better resource assessment will help solar developers plan for the future and allow them to build climate-resilient portfolios – so that projects built following low bids continue to be profitable 15 years down the line.

Thinking long-term

Perhaps most importantly of all, it’s essential that developing projects in India is no longer a case of ‘build and forget’. The demands of investors – both domestic and international – are increasing, meaning that a short-term focus is no longer viable. Ultimately, ensuring long-term performance will prove essential to the success of the industry.

Current business models in the Indian solar market have driven a trend towards the use of minimum quality irradiation data. When tendering for selecting an EPC contractor, some developers outsource the energy due diligence process and design optimization to the EPC, thereby losing their oversight and control of data quality used throughout the project’s development and operations phase.

Developers try to mitigate the weather risk by requiring EPC contractors to provide generation guarantees for the first year of plant operation. However, the performance guarantee test is often based on simple calculations with many loopholes – thus exposing developers to significant financial risk over the project lifetime.

Another cause of short-termism is the practice of companies to oversee energy generation for the first two years then sell the project, after meeting the performance warranty. However, investors care more about long-term performance.

In this context, developers need to become more accountable for the long-term production of their solar projects and ensure that critical performance estimates and design decisions are informed by an appropriate standard of resource data.

It can be tempting to look at data as a check box to fill to get an auction bid over the line. However, as Indian solar enters a new phase of competition, brings in advanced new technologies and seeks to satisfy increasingly demanding investors – all amid a changing climate – there is no excuse for cutting corners when it comes to understanding how these assets will perform over their lifetime. Only the bids that are backed by robust resource data will ultimately lead to successful solar projects.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.