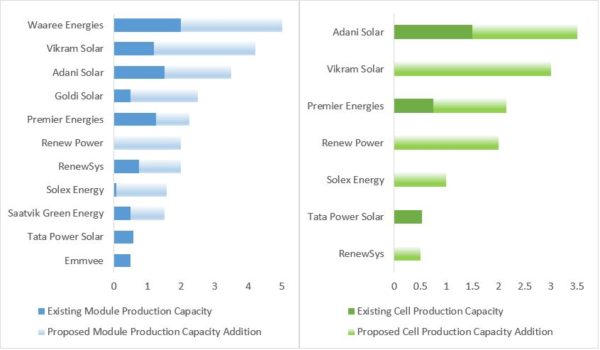

A new JMK Research report says India could add 13.75 GW of solar module and 6.9 GW cell capacity in the next 18 months. Module manufacturers with 1 GW+ capacity (Waaree Energies, Adani Solar, Premier Energies, and Vikram Solar) alone have proposed a cumulative capacity addition of 9 GW modules and 6.4 GW cells. This also includes Vikram Solar’s plan to set up a 3 GW fab for modules, cells, and wafers in Tamil Nadu in the next four to five years.

Two key manufacturers have already achieved a certain degree of expansion recently. In April this year, Tata Power Solar expanded its cell manufacturing capacity from 300 MW to 530 MW with mono-PERC (passivated emitter and rear cell) and module from 400 MW to 580 MW with mono-PERC, half-cut technology. In June, Premier Energies has expanded its module manufacturing capacity from 500 MW to 1.25 GW with the addition of 750 MW cell capacity.

JMK Research

Technology shift

JMK Research highlighted the Indian manufacturers are upgrading their capabilities to meet the evolving domestic and foreign demand for higher-efficiency modules. In terms of PV technology, the mono-PERC type is rapidly gaining prominence over the multi-crystalline type in India too. The domestic utility-scale solar market’s module preference would shift entirely to mono-PERC by December this year.

Furthermore, the wafer size transition from M2 (156.75 mm2), M2.5 (158.75 mm2) to M6 (166 mm2), M10 (182 mm2), M12 (210 mm2) is leading to the enhancement of module power output and efficiency.

In particular, the domestic rooftop solar segment is seeing the trend towards bigger and bifacial modules. “M6 wafer-based modules are expected to become mainstream in new domestic rooftop solar capacity additions soon. Also, domestic manufacturing capacity for bifacial modules is expanding as manufacturers foresee high growth potential in demand for these modules, especially from the residential rooftop market,” stated JMK.

Government push

The series of new capacity announcements follow the introduction of Basic Customs Duty (BCD) and a Production-linked Incentive (PLI) scheme by the government to reduce solar import dependence and scale domestic manufacturing capabilities.

Currently, India meets more than 80% of its solar module demand through imports from other Asian countries such as China, Vietnam, and Malaysia. In CY2020, the nation imported US$ 1,527 million worth of solar cells and modules.

The country’s ambitious target of an additional 280 GW of solar power installation by 2030, along with its high dependence on solar imports, warrants robust development of the domestic PV manufacturing industry, which currently has a cumulative 4 GW cell and 16 GW module capacity. The manufacturing capacity for upstream stages of polysilicon, ingots, and wafers is absent primarily due to high production costs. The lack of scale and integration of PV manufacturing has been a critical barrier to the nation’s solarization program.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.