India would need cumulative investments of US$ 10.1 trillion to achieve the ‘net-zero emissions by 2070’ goal as announced by prime minister Narendra Modi at the COP26 summit recently, says a study by the CEEW Centre for Energy Finance (CEEW-CEF).

According to the study, these investments would help decarbonize India’s power, industrial, and transport sectors. The mobilization of investments to achieve net-zero expectedly will be sourced from domestic banks, non-banking finance companies (NBFC), and debt capital markets, both domestic and international.

However, a gap will remain between the total investment required to achieve net-zero and the amount that can be reasonably mustered from these conventional sources.

The study estimates that India could face a significant investment shortfall of US$ 3.5 trillion to achieve its net-zero target. Hence, investment support of US$ 1.4 trillion, in the form of concessional finance, would be required from developed economies to mobilize foreign capital that bridges the gap.

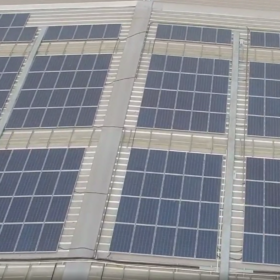

The CEEW-CEF study ‘Investment Sizing India’s 2070 Net-Zero Target’ also highlighted that the majority of the investments would be needed to transform India’s power sector. Such investments, totaling US$ 8.4 trillion, would be required to significantly scale up generation from renewable energy and associated integration, distribution and transmission infrastructure. Another US$ 1.5 trillion would have to be invested in the industrial sector for setting up green hydrogen production capacity to advance the sector’s decarbonization, and further $198 billion in mobility infrastructure.

Dr Arunabha Ghosh, CEO, CEEW, said: “At COP26, India announced bold near-term and long-term climate targets. Our analysis finds that a transition to net-zero emissions would require mammoth investment support from developed countries. Developed countries must ramp up hard targets for climate finance over the coming years. Also, on the domestic front, financial regulators like RBI and SEBI need to create an enabling ecosystem for financing India’s transition to a green economy. Finally, given the size of the investments required, private capital, from both domestic and international institutions, should form the bulk of investment, while public funds should play a catalytic role by de-risking investments in existing and emerging clean technologies.”

The CEEW-CEF study also pointed out that India’s US$ 1.4 trillion concessional finance requirement would not be uniformly spread across the five decades till 2070. The average annual concessional finance requirement would vary from US$ 8 billion in the first decade to US$ 42 billion in the fifth decade.

Vaibhav Pratap Singh, Programme Lead and lead author of the study said, “India’s 2070 net-zero target is a bold commitment that would not only contribute to global decarbonization efforts but would also shape how businesses and jobs of the future would look like. Traditional domestic and foreign sources such as domestic banks and non-banking financial companies (NBFCs), and debt capital markets – both local and international – would not be able to fund the massive investments needed by themselves. Therefore, access to foreign capital, on concessional terms, would have to play a key role.”

This study follows CEEW’s ‘Implications of a Net-zero Target for India’s Sectoral Energy Transitions and Climate Policy’ study, launched on October 12, which estimated how five key sectors would need to evolve if India were to achieve net-zero by 2070.

According to that study, India’s total installed solar power capacity would need to increase to 5,630 GW by 2070. The usage of coal, especially for power generation, would need to peak by 2040 and drop by 99% between 2040 and 2060. Further, crude oil consumption across sectors would need to peak by 2050 and fall substantially by 90% between 2050 and 2070. Green hydrogen could contribute 19% of the total energy needs of the industrial sector.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.