At present price levels, solar modules account for about 65% of the overall cost of setting up a solar power project in India. Domestic production only makes up 20% of the annual requirements, so there is heavy reliance on imports from China, exposing the country’s ambitious renewable energy plans to geopolitical risks.

Hence, despite the government’s focus on boosting domestic manufacturing of modules and setting up fully integrated manufacturing lines, it would take a significant amount of time for the domestic ecosystem to be fully functional and meet demand by itself. In the interim, import dependency will continue.

Over the past 18 months, prices of solar modules have risen significantly, putting pressure on the return metrics for the developers. The landed cost of solar modules has gone up further as the Ministry of New and Renewable Energy has announced the applicability of basic customs duty (BCD) of 25% on imported solar cells and 40% on imported modules from April 1, 2022. The Goods and Services Tax (GST) council had also increased GST on the modules to 12% in October 2021 from 5%.

Rising prices

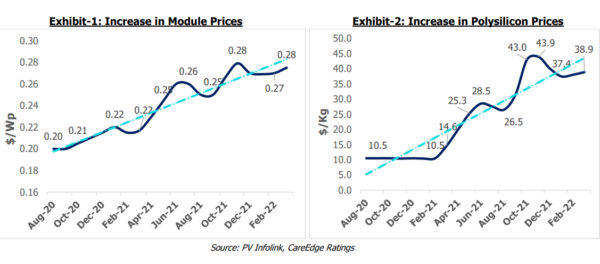

Prices of imported mono PERC PV modules in India have risen by over 35% (Exhibit 1) from around $0.20 per watt in August 2020 to about $0.28 per watt in March 2022. This is primarily due to higher polysilicon prices (Exhibit 2), which is a crucial input for PV modules.

There are several key reasons for the increase in module prices.

Supply-chain disruptions: Polysilicon is a key raw material in solar module manufacturing. Over the years, its price reduction has been a significant factor contributing to the decline in solar module prices, leading to competitive tariffs. However, polysilicon prices increased significantly from $10 per kg in August 2020 to $44 per kg in November 2021. They are currently around $39 per kg. This multifold increase in prices has primarily resulted in higher module prices.

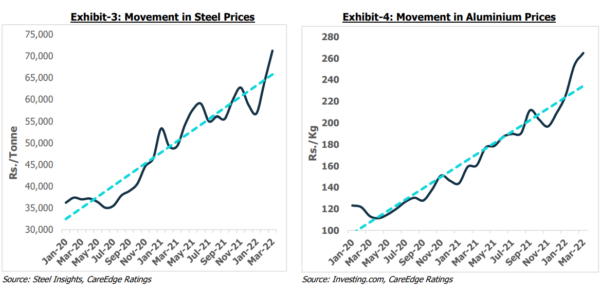

Other disrupting factors in the module supply chain include price hikes for commodities such as glass, steel and aluminum, shortages of containers, and an increase in freight rates. Steel and aluminum prices have increased by around 95% and 115%, respectively, from January 2020 to March 2022. Such disruptions were exacerbated due to various pandemic lockdowns.

Impact of BCD and ALMM: As BCD became applicable from April 2022, the developers, to save on costs, have preemptively stocked modules ahead of time. This is reflected by an increase in the imports to 9.7 GW in the fourth quarter of fiscal 2022. The government has mandated the procurement of modules for use in government projects, government-assisted projects, projects under government programs, open access, and net metering projects from original equipment manufacturers (OEMs) that are a part of the Approved List of Models and Manufacturers (ALMM). This presently only includes domestic manufacturers. Anticipating a rise in the demand, the domestic manufacturers have also increased their prices.

Rising demand for solar modules: Solar power installations have increased at a compounded annual growth rate (CAGR) of 23% from calendar year 2016 to calendar year 2021, as a decline in solar costs have made it competitive compared to other sources of generation. Higher emphasis on procuring power through cleaner sources and global commitment to reduce carbon emissions has supported demand, too. This has resulted in demand outpacing supply over the past few quarters and, in turn, increased the cost of modules. The power crisis in China, which accounts for a major portion of global production, has also impacted the supply of modules.

These inflationary pressures are likely to put upward pressure on the capital cost of solar power projects and impact the returns for the developers who have projects under construction. Moreover, the bid tariffs in the subsequent auctions are likely to increase, as the developers will have to factor in the increase in input prices along with the implementation of BCD on solar PV cells and modules and the recent increase in GST.

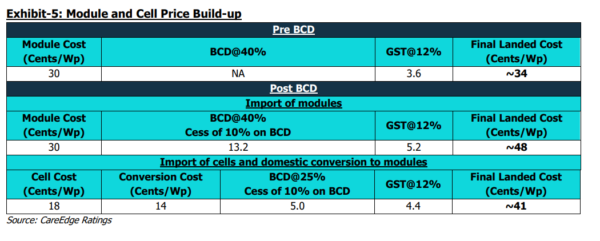

At present, the delivered price (on cost, insurance, and freight [CIF] basis) of imported solar modules and cells from China is around $0.30/Wp and $0.18/Wp, respectively. Additionally, modules and cells attract BCD of 40% and 25%, respectively, and cess of 10% on BCD. A GST of 12% is applicable on the solar equipment.

To be more cost-effective, Indian developers are exploring framework agreements with domestic module manufacturers, assuring them substantial offtake over a period. As a part of this arrangement, domestic OEMs would import cells from the preferred Chinese manufacturers and convert them into modules for Indian developers, thereby saving cost, as there is a difference between the BCD applicable on cells vis-a-vis modules.

The build-up of module prices under different scenarios is tabulated below:

As reflected in the table above, the landed price of imported modules has increased by around 41% from 34 cents in the pre-BCD regime to $0.48 in the present regime. Most of the developers are expected to source imported cells and procure modules domestically, which will moderate the price increase to $0.o7 to $0.o8. However, given the limited domestic module manufacturing capacities, and most of them are not capable enough to manufacture high-efficiency mono PERC modules, the availability of domestic capacity would remain a challenge in the near to medium term.

Recent trends

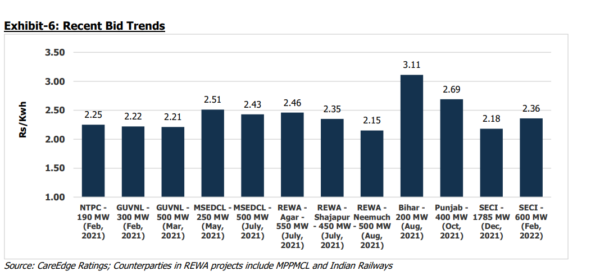

While the impact of the rising module prices and the imposition of the BCD on imported PV modules were expected to increase the bid tariff rates by about 55 paise/kWH to 60 paise/kWh, the actual increase in the bid tariff rates remained lower, with most of the bid tariffs remaining around INR 2.3 ($0.030)/kWh to INR 2.4/kWh. One of the bids witnessed a tariff rate of INR 2.15/kWh in August 2021 (tariffs of recently bid projects are presented in Exhibit 6). This can be attributed to the favorable interest rate regime, lower expected return thresholds, and location-specific elements like lower capital costs associated with the transmission infrastructure and favorable irradiation prospects.

The tariffs in recent bids have not increased commensurate to the rise in module prices as developers expect the prices to correct over the next six to nine months once the supply chain challenges alleviate. Some developers have even fast-tracked their purchases to avoid any incurrence of BCD.

As per CareEdge Ratings, if the prices do not correct, a significant portion of the capacity under development would remain exposed to the implementation risk. The viability of competitively bid-based solar tariffs is critically dependent upon capital costs, plant load factor (PLF) levels, and long-tenure debt availability at cost-competitive rates.

With the use of imported modules in most cases, capital costs remain exposed to the volatility in the PV module price level and INR-USD exchange rate. The increase in module prices and implementation of duties and higher taxes has already resulted in moderation in debt protection and return metrics of the projects.

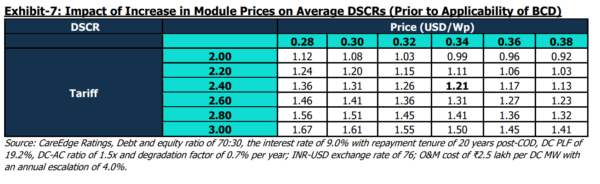

Without the application of BCD, a project having a bid tariff of INR 2.4/kWh and sourcing modules at $0.34/watt would have resulted in an average project debt-service coverage ratio (DSCR) of around 1.2 times.

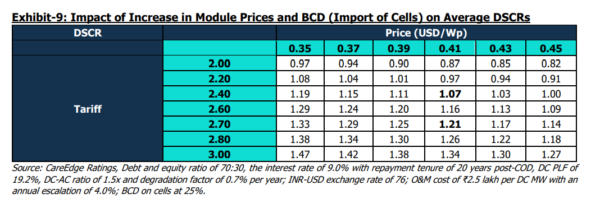

Post application of BCD, the already-won projects, wherein the modules have not been sourced, are expected to turn unviable, and the same has been reflected in the exhibit below. For a project to provide the same level of debt coverage and operate with imported modules, the bid tariffs should be closer to INR 3/kWh at the prevailing module prices.

However, if a project deploys only imported cells, wherein the modules are manufactured domestically from the imported cells, the expected tariff to maintain the same level of debt protection would be around INR 2.7/kWh. Moreover, an increase in the module price level by about $0.02/watt is likely to moderate the debt service coverage metrics for the project developers by about 4 basis points.

Future outlook

CareEdge Ratings expects the rise in module prices to adversely impact the project returns for developers who have not been able to source the modules so far, as a rise in the module price fails to abate. Moreover, with the basic customs duty kicking in from April 1, 2022, the landed cost of solar modules has further gone up jeopardizing the returns for projects, which cannot avail recovery of extra project costs under the change in law clause. Furthermore, CareEdge Ratings expects the future bid tariffs to increase to around INR 2.7/kWh to ensure similar returns for developers, provided module prices remain firm.

There has been significant traction in solar power installations over the past few years. Despite its late and slow start, the cumulative solar power capacity has surpassed the installed wind power capacity. As of March 31, 2022, India has an installed solar capacity of 54 GW. The overall renewable energy installations have increased at a CAGR of 17% from fiscal 2016 to fiscal 2022.

Over the years, the renewable energy industry has benefitted from the government’s strong policy support, India’s largely untapped potential, the presence of creditworthy central nodal agencies as intermediary procurers, and improved tariff competitiveness. Going forward, with India setting up an ambitious target of achieving 500 GW non-fossil fuel capacity by 2030, the regulatory framework is expected to remain supportive.

However, the developers are expected to face challenges in the near term on account of the rising cost of modules and other ancillary products along with the imposition of basic customs duty on cells and modules from April 2022 onwards, and increased GST on solar equipment, which is expected to further drive up costs and result in an increase in bid tariffs for new projects. Nevertheless, CareEdge Ratings estimates the tariffs of the upcoming projects to remain competitive below INR 3/kWh.

Author: CareEdge Ratings

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.