Avaada Group announced this week that it has raised $1.07 billion for its green hydrogen and green ammonia ventures in India as a part of its ongoing $1.3 billion fund raise plan.

Brookfield Renewable, through its Brookfield Global Transition Fund (BGTF), will invest up to $1 billion in Avaada Ventures.

Global Power Synergy Public Co. (GPSC), a 42.9% equity partner in Avaada Group’s renewables arm Avaada Energy, will further invest $68 million in Avaada Energy for releasing debt obligations and supporting the growth.

Avaada Group is also in advanced discussions with potential investors to raise another $200 million.

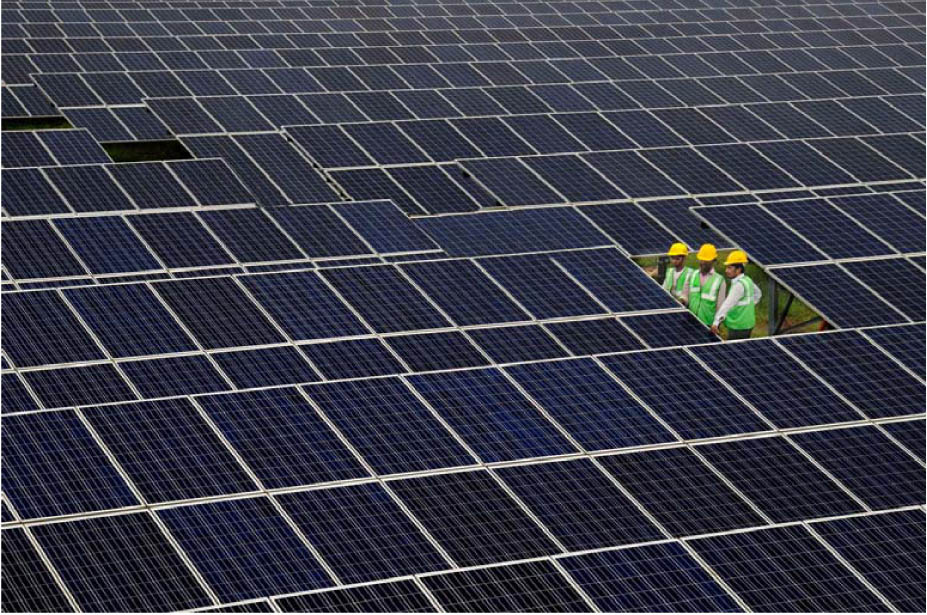

Avaada Group currently operates a renewable energy portfolio of 4 GW with plans to reach 11 GW by 2026 and 30 GW by 2030. It has diversified into the production of electrolyzers, green hydrogen, and green ammonia. The Group has also expanded its footprint into the solar PV supply chain with the manufacturing of solar cells and modules. Towards this end, it recently won production-linked incentives of INR 961 crore ($116.78 million) for setting up 3 GW of wafer-to-module capacity.

Vineet Mittal, chairperson and founder of Avaada Group, said, “Avaada Group is building an integrated ‘Sand to molecule’ business aligned for the global energy transition towards decarbonization… The collaboration [with Brookfield] will support us in pursuing exciting opportunities as we play a critical role in meeting the exponential growth of sustainable energy and position ourselves at the forefront of the global energy transition.”

Brookfield Renewable is the flagship listed renewable and transition company of Brookfield Asset Management, a leading global alternative asset manager with around $800 billion of assets under management. In India, Brookfield has over 9 GW of wind, solar and hybrid assets in various stages of execution across seven different states.

Nawal Saini, managing director, Renewable Power & Transition, Brookfield, said their strategic partnership [with Avaada] will leverage Brookfield’s global track record, access to capital, and operational expertise alongside Avaada’s strong local footprint, to enable their vision for the energy transition business.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.