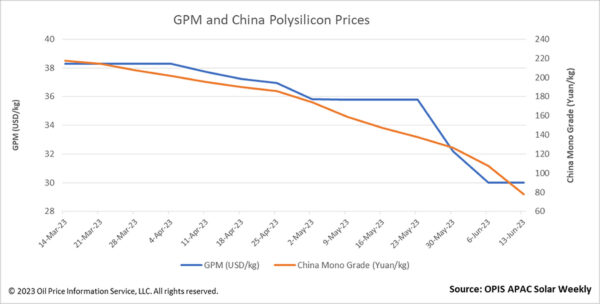

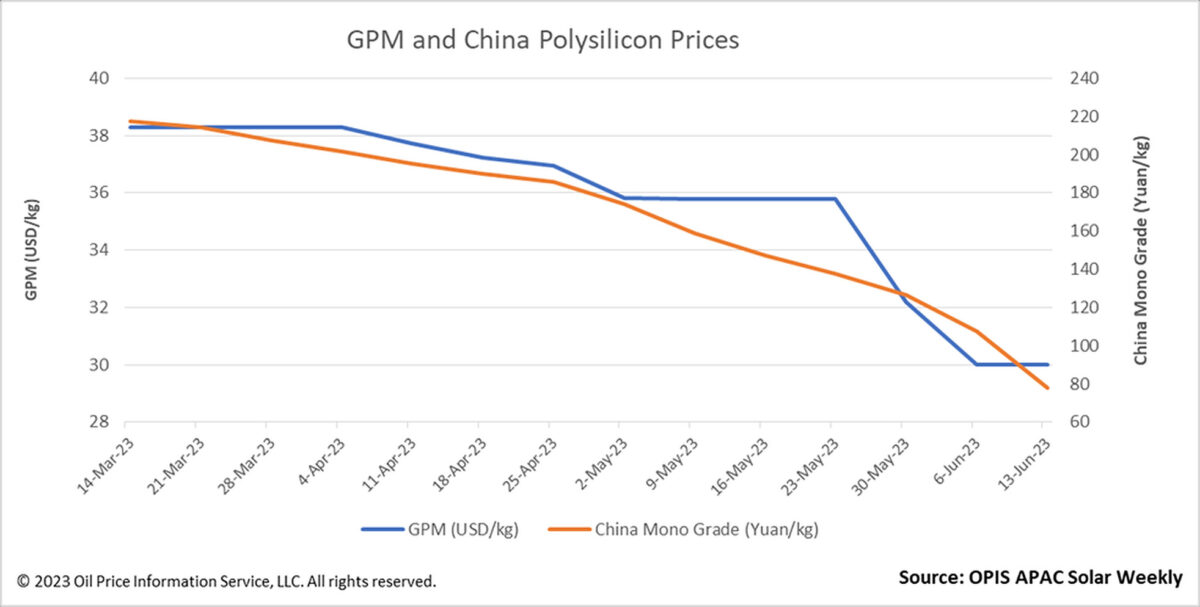

The Global Polysilicon Marker (GPM), the OPIS benchmark assessment for polysilicon outside China, held steady this week at $30 per kg, with the market seeing limited transactions and fewer price quotes, according to OPIS Solar.

Ex-China polysilicon prices remained the same for a second week running, with most players offering no new price points during OPIS’ market survey. Instead, and extending the pattern from last week, multiple sources gestured at how prices in China’s polysilicon market remain in freefall.

Prices for polysilicon in China, assessed by OPIS as China Mono Grade, continued to break records, diving even further to CNY78 ($10.96)/kg, its lowest figure in almost three years, which also leaves the hitherto-much-discussed, psychologically significant figure of CNY100/kg in the dust. This 27.44% plummet takes the crown from last week’s already-dramatic percentage plunge, and is now 2023’s largest percentage drop in China polysilicon prices.

This precipitous decline comes as China’s market fundamentals also remain unchanged, with polysilicon output continuing to exceed demand, as one source reiterated. Transactions take place in reality at 10% below the figures quoted by large and small factories alike, and wafer producers now have a rather strong negotiating position when placing purchasing orders with polysilicon businesses, the source added.

With the exception of a few prominent manufacturers, many polysilicon producers can currently no longer break even at prices between CNY70/kg and CNY80/kg, and a brutal pricing war is currently in full swing, according to a source. These major producers are expected to continue waging a price war, taking advantage of their lower production costs and larger production scale this and next year to deny small and newer players market share, the source added. In this way, they can maintain their high ground in polysilicon when the segment faces significant oversupply.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.