From pv magazine USA

According to recent forecasts, the solar market will triple in size over the next five years, amounting to a total installed solar capacity of 378 GW by 2028. However, this rapid growth brings some challenges, as noted in “Build Together: Rethinking solar project delivery,” released by McKinsey. The report notes that the solar industry faces significant construction and labor shortages that could worsen over the next three to five years, and demand for engineering, procurement and construction (EPC) will also grow rapidly.

Based on McKinsey’s analysis, to serve utility-scale solar projects, EPC capacity would have to almost triple to meet the anticipated demand of approximately 50 GW installed in 2027. Instead, the report suggests rethinking traditional practices around project delivery.

To capture the potential value of U.S. renewables, estimated at $700 to $800 billion in capital investments to build onshore wind and solar projects through 2030, EPCs “should establish new approaches to partnerships, risk ownership and contracting, workforce development, and digital and technology adoption,” the report contends.

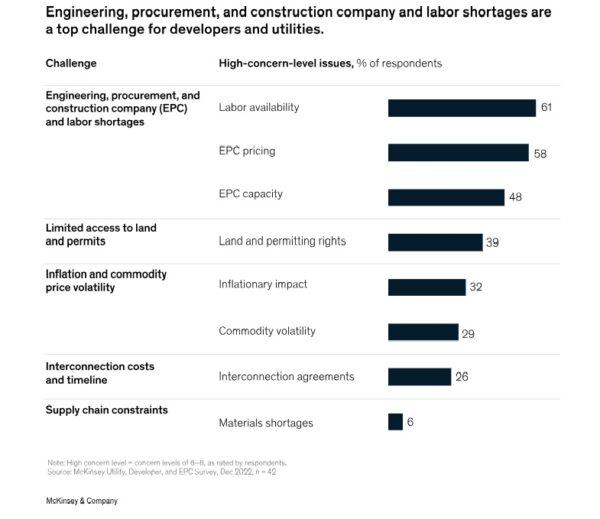

EPC and labor shortages are a top challenge for renewables players. The report notes that these challenges have overtaken other obstacles such as limited access to land and permits, inflation and commodity price volatility, and interconnection. As a result, collaboration is key and will be achieved through strategic partnerships, risk ownership and contracting, workforce development, and digital and technology adoption. One recommendation in the report is for EPCs and developers to work more closely together, integrating engineering times and promoting transparency on pricing and risk.

By making such changes, the market could shift to new contracting structures where EPCs and developers could pursue portfolio partnerships. Both parties would be incentivized to take on supply chain and workforce challenges. According to the report, leading developers have locked in capacity with two or three core EPC partners on average, which brings benefits to both sides. Such partnerships can range from nonbinding relationship-based commitments to formal master service agreements with bilateral contractual commitments. But the overall benefit is that both partners share common objectives, such as increased visibility and joint planning of project pipelines, early engineering involvement and continuous improvement of designs, and collaborative workforce attraction and development programs.

The McKinsey report indicates that rapid market growth opens the door to new players in the renewables industry. For example, regulated utilities are increasingly interested in developing renewables to take advantage of the alternative Solar Production Tax Credit within the Inflation Reduction Act. Diversified EPCs are also expanding into solar. And local and regional contractors of all types are being retrained as solar installers, thus entering the woefully deficient solar workforce.

As partnerships are formed and both risk and opportunity are shared, stakeholders will have to shift their contracting approach to streamline project delivery and reduce disruptions to agreements. Contracting itself will become more collaborative as the stakeholders adjust to sharing the responsibilities and challenges. The report notes that collaborative contracting is used in other capital-intensive industries, where pilots have improved both costs and schedules by 15% to 20% versus traditional contracts, according to prior McKinsey research.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.