India’s transition to a net-zero economy by 2050 presents an investment opportunity amounting to at least $12.7 trillion, according to the New Energy Outlook: India report published by Bloomberg New Energy Finance (BloombergNEF).

The report details two scenarios for India’s energy system and the implications of the country’s transition opportunities and challenges. The baseline Economic Transition Scenario describes an economics-led transition without emission constraints. Under this scenario, the country makes significant progress toward energy independence and decarbonization but does not achieve either goal by 2050.

The second, the net-zero scenario, envisages enhanced government support and private-sector investment. It is consistent with net-zero emissions by 2050 with no reliance on unproven technologies. It enables India to achieve its mid-century energy independence goal at the lowest cost.

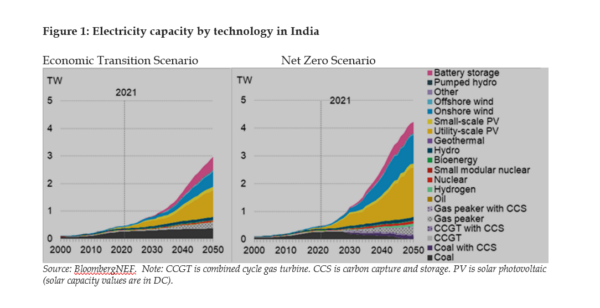

India added 53 GW of solar and wind between 2018 and 2022, of which 16 GW of utility-scale solar was installed in 2022 alone. Yet, solar and wind still account for less than a quarter of India’s power generation capacity, with coal dominating the rest. As a result, India’s electricity generation remains the country’s largest source of emissions.

BloombergNEF’s analysis finds that maximizing the deployment of solar and wind, supplemented by additions of nuclear, energy storage, and carbon capture and storage (CCS) for thermal power plants, is the cheapest way for India to increase electricity access while decarbonizing its power supply.

New wind and solar power plants in India have already achieved a lower levelized cost of electricity generation than new thermal power plants. The cost of electricity generation from new solar and wind power plants will become cheaper than the running cost of existing coal plants by the mid-2030s.

In the net-zero scenario, the total installed capacity of wind and solar power undergoes a 30-fold expansion, from 99 GW in 2021 to 2,998 GW by 2050. Together, wind and solar generation account for 80% of electricity supplied in 2050, while nuclear provides 9%. The remainder is met by hydro, biomass, hydrogen-fired thermal plants, and thermal power plants equipped with CCS.

Even under the economic transition scenario, BloombergNEF’s baseline scenario, least-cost power system modeling shows that solar and wind become the dominant source of electricity supply, accounting for 67% of electricity generated in 2050.

“India needs to double down on increasing flexibility in the grid to integrate the large capacities of variable wind and solar,” said Rohit Gadre, India Research Senior Associate at BNEF. “Our modeling shows that multiple solutions can co-exist, including batteries, pumped hydro storage, and peaker gas plants.”

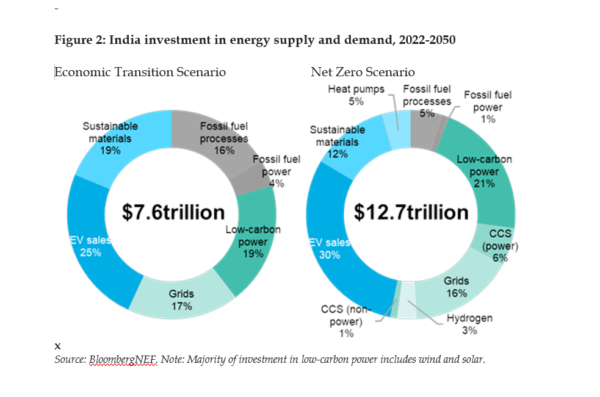

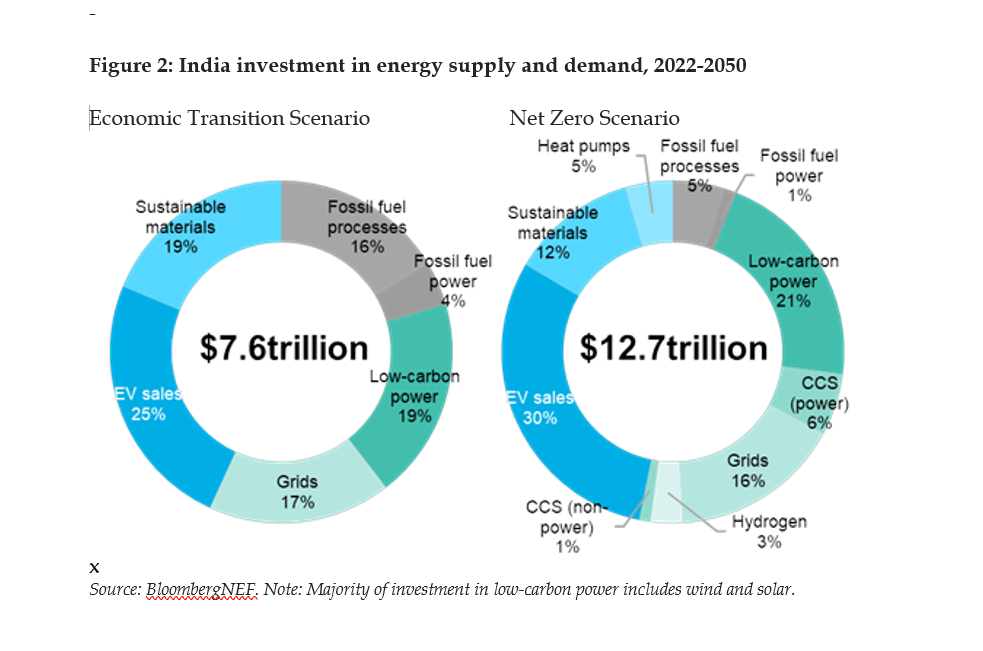

Under the economic transition scenario, investment in energy supply and demand will reach $7.6 trillion over 2022-50, with an annual average of $262 billion.

To stay on track for net zero, according to BloombergNEF’s net-zero scenario, investment levels are 1.7 times higher at an annual average of $438 billion and a total of $12.7 trillion to 2050. Total investment in fossil-fuel power drops from $317 billion in the economic transition scenario to $142 billion in the net zero scenario. To abate emissions from the remaining use of fossil fuels in the net-zero scenario, India needs $870 billion in investment for CCS. Electric vehicle sales account for the largest share of investment for energy demand in both scenarios. In the net-zero scenario, $3.9 trillion is spent deploying EVs.

“Transitioning to a zero-emission vehicle fleet by 2050 will require bold policy efforts by the state and national governments. Falling battery costs are set to accelerate EV adoption post-2030 which will also spur local manufacturing from automobile and battery makers,” said Komal Kareer, India Research Associate at BloombergNEF.

“India can all but eliminate dependence on fossil fuel imports by 2047, its centennial,” said Shantanu Jaiswal, Head of India Research at BloombergNEF. “By accelerating deployment of mature clean technologies such as solar, wind and electric vehicles, India could create more domestic economic opportunities while reducing emissions and strengthening its energy security.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.