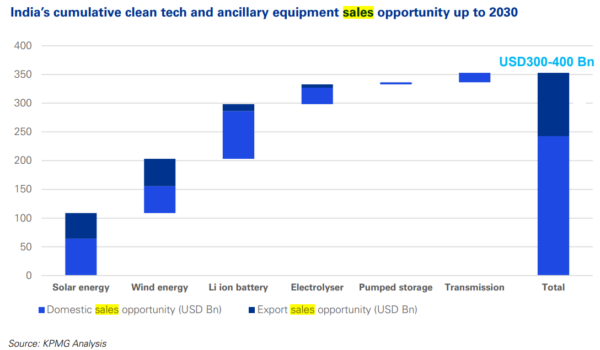

India has the ingredients to develop as a credible option for clean technology manufacturing. If both domestic consumption and exports are factored, it has a $300-400 billion cumulative market opportunity to harness within this decade, according to a new report by KPMG.

India envisages to be climate neutral by 2070. The nation aims to become energy-independent by 2047. (An energy independent nation is one which need not import energy resources to meet its energy demand.) The government’s plan involves green hydrogen as an alternate fuel to fossil-based product.

The KPMG report estimates India will need to invest $350-400 billion per year until 2047 to achieve its energy transition commitments. This investment will be required in clean energy technologies, necessary infrastructure and energy efficiency measures.

Achieving the 2047 target translates into an 85% share of non-fossil fuel in power capacity mix with ten times increase in the installed RE capacity from 160 GW in 2022 to 1,600 GW by 2047. EVs should make up 100% of new passenger vehicle sales by 2047, among other energy transitions. Also, the nation must reach green hydrogen production capacity of 25 mmt in 2047, requiring 180 GW of electrolyzer capacity.

Globally, energy transition might involve an annual investment of $4.5 trillion a year until 2050, according to the report.

The report adds successful energy transition within India and globally will require supply chains to be reimagined.

Currently, China owns 79% of solar, 64% wind, 76% battery and 41% of electrolyzer manufacturing globally. As a result, there is a global attempt to diversify and secure renewable energy supply chains by adopting approaches such as the ‘China + 1’ strategy.

High captive demand, increased supplier base, government support, regulatory enablers and unique domestic capabilities make India a strong contender in this space, according to the report.

The report adds energy transition could create 5-6 million jobs by 2030 and 9-10 million by 2047 in India. Almost 30% of the 8-9 million jobs will be in manufacturing and the rest in construction and installation, operations and maintenance, and fuel supply.

India needs to develop a strong skilling strategy for areas such as R&D, where there are significant skill gaps. New technologies such as batteries, green hydrogen, and carbon capture utilisation and storage demand deep skills and would need a more aggressive approach to talent development. Cost competitiveness in electrolyzers would need capabilities to be enhanced in R&D, design, engineering, etc.

The cost of green hydrogen is almost twice that of grey hydrogen– cost differential will need to be brought down significantly through innovation in RE as well as the entire green hydrogen value chain.

The report highlights Indian manufacturers need to rapidly evolve a strategy to enhance their capabilities. They must strengthen their manufacturing and sourcing strategy and focus on value engineering, manufacturing efficiency through visual and digital enablers, and effective capacity expansion management. In sourcing they need to widen their base to include significant non-Chinese players and eventually develop a more domestic ecosystem of research and innovation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.