From pv magazine Global

Analysis firm Wood Mackenzie forecasts the solar industry will shift from a high growth industry to a slower-growing, mature industry in 2024.

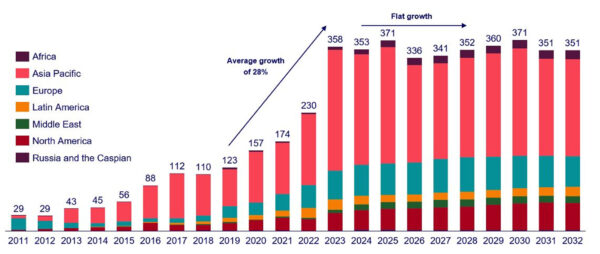

According to predictions in a new report shared with pv magazine, annual average growth will be flat over the next eight years, bucking a trend of rapid growth over the last decade. Between 2024 and 2032, global solar installations are expected to reach around an average of 350 GW each year, peaking at 371 GW of installed solar in 2025 and 2030.

“Starting in 2024, the industry is officially past the inflection point, characterized by a slower growth pattern. The global solar market is still many times larger than it was even a few years ago, but it’s natural for an industry’s growth to slow as it matures,” the report says. “In this new era of solar growth, companies will need to be more diligent and focused than ever. Competition amongst suppliers will intensify and efficiency improvements will be critical to remaining profitable”.

Wood Mackenzie says a few major markets are driving this new growth pattern. China’s solar market is expected to reduce slightly in 2024. While it will continue to be the world’s largest market, it is predicted to shrink due to grid infrastructure investments not keeping pace with project growth, changing revenue schemes for utility-scale solar reducing prices and distributed solar growth slowing.

Europe, which saw annual installation growth of 38% in 2022 and 26% in 2023, is expected to see an average annual growth of 4% over the next five years. The report cites a spike in retail rates as the energy crisis wears off, the slowing down of distributed solar growth and grid infrastructure capacity limits for the slowing down.

Average growth in the United States, which reached 27% between 2019 and 2023, is expected to fall to 6% between 2024 and 2028. But Wood Mackenzie expects the full breadth of the Inflation Reduction Act to materialize in 2024. It predicts this will lead to more contracted utility-scale solar projects, benefits for the distributed solar segment, and see the US domestic module manufacturing sector nearly triple in 2024, with 40 GW of capacity expected to be operational by the end of the year.

The analysis firm also forecasts solar manufacturing will face “a reckoning” in 2024.

Market expansion has been primarily driven by China, whose module manufacturing capacity alone is already nearly three times global demand. This oversupply is driving China to module price record lows and Wood Mackenzie says cheaper Chinese modules will challenge many countries’ plans to build out vertically integrated domestic solar supply chains. It predicts many planned facilities will fail to materialize, while existing facilities will be hard-pressed to stay in business as utilization rates decline.

“This is not new – solar manufacturing is known as being a notoriously challenging business. But the sector has also never been this large. With global demand growth slowing, manufacturers will have to be as innovative as ever to remain a going concern,” the report states.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.