From pv magazine print edition 3/24

A perfect storm of lithium supply shocks, manufacturing repatriation efforts, and higher clean energy ambitions have highlighted the need for energy storage alternatives to lithium-ion batteries.

Long-duration storage will increasingly be required for grids as global clean power generation increases. Many alternatives to lithium ion offer lower life-cycle costs, better safety, easier maintenance, and, notably, less dependence on critical raw materials.

Lithium ion currently supplies more than 90% of the world’s energy storage capacity, mainly in short-duration, two- to four-hour applications. Eight-hour-plus storage is in relatively low demand, as renewables dominate in only a handful of locations.

Long-duration alternatives

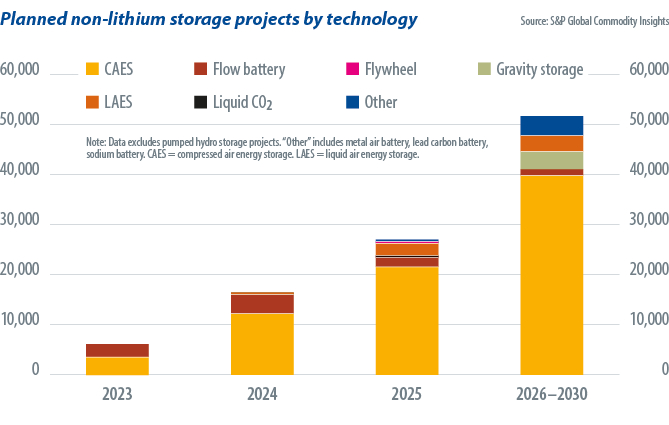

There is no established long-term business model for long-duration storage either, but 2023 was a record year for long-duration storage procurement and non-lithium support schemes and strategic partnerships. The U.S. Department of Energy and the California Energy Commission, a state planning body, announced funding for more-than-10-hour, non-lithium energy storage. The United Kingdom is backing novel approaches for more-than-six-hour storage, including compressed air energy storage (CAES), flow batteries, liquid air energy storage (LAES), and pumped hydro storage (PHS).

Agreements have been made between utilities and non-lithium energy storage providers in the last year. In Germany, for instance, utilities are considering iron-zinc batteries and CAES to repurpose spent coal mines.

Other, technology agnostic, long duration energy storage procurement plans have also been announced recently. Such funding exercises, while attractive to alternative energy-storage approaches, also offer lithium ion projects the chance to be eligible for support.

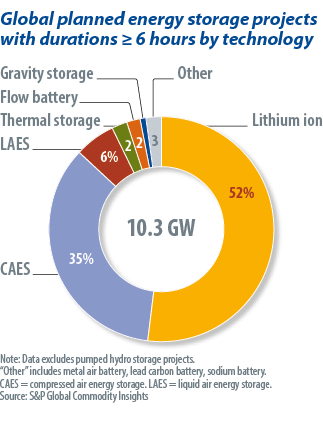

Australia launched a long-duration energy storage tender for 2 GW worth of eight-hour-plus projects. Of the three announced winners to date, two are lithium ion projects and one is CAES. More recently, Italy announced a 9 GW procurement for eight-hour duration storage, to be held at the end of 2024. The relevant documents mention lithium ion and PHS as key contenders. Historically, it had been thought that scaling lithium ion up to such storage duration would not be cost effective. Over the past year, however, fierce competition between lithium ion suppliers in China, and falling metals prices have been driving down lithium ion costs, creating competition at storage durations previously thought to be uneconomic for the mainstream technology. Six-to-eight-hour lithium ion projects have already been seen in China, the United States, and Australia, and make up more than 50% of all planned storage projects with a duration of more than six hours. This adds an extra challenge for alternative technologies that aim to compete at that specification.

Another key challenge for many non-lithium storage approaches is the lack of manufacturing scale that lithium ion battery makers leverage from the electric vehicle (EV) industry. The rising popularity of EVs has enabled dramatic lithium ion cost reductions over the past decade.

Non-lithium storage technology that can leverage existing supply chains from adjacent industries in the same way lithium ion has – CAES, LAES, sodium ion batteries, and gravity storage, for instance – are well placed to scale production.

The components and equipment used for CAES, for example, have several decades worth of track record using off-the-shelf turbomachinery from the power generation industry. Existing supply chains for CAES are already well established.

Sodium-ion tech

Another notable development in the energy storage space is the growing number of sodium ion manufacturing announcements. Sodium ion technology benefits from well-established component supply chains and similar manufacturing processes to lithium ion. The much lower raw material cost of sodium means sodium ion batteries could, at scale, achieve a lower cost than lithium ion at durations even beyond eight hours. Proof of commercial projects and a ramp-up of manufacturing production needs to develop further for that to happen. The first 100 MWh sodium ion project announcement in China is a sign of rapid movement in that direction already.

Technology that only serves the energy storage industry may struggle to scale up manufacturing cost-effectively for more bespoke components, especially if suppliers are competing with lithium ion.

Looking ahead, a fundamental need for long duration storage solutions far beyond eight-hour duration is inevitable if fossil fuel-based grid flexibility is to be phased out and renewables are to account for the majority of power generation. It is critical that grid flexibility requirements are determined in advance of such a need actually arising. That will require dedicated flexibility assessments at a system level, something which we have already seen positive steps toward in Europe’s electricity market reform in 2023.

Inherent challenges also need to be overcome to create a long-term business case for long duration storage solutions, which will become increasingly important as renewables reach a tipping point in energy generation and therefore require multi-day storage solutions.

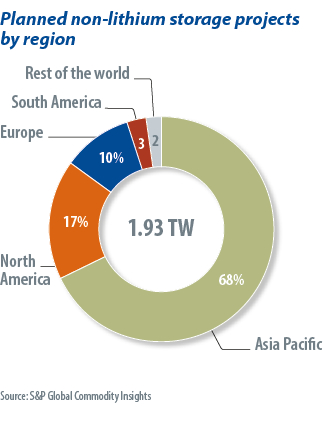

The persistent price competition that is leading to a reduction of lithium system costs poses a significant hurdle for alternative technology as suppliers strive to compete with the established approach. Further strategic partnerships and long-duration procurement plans will continue to drive future pipelines of non-lithium energy storage solutions, with those able to scale most effectively and prove commercial projects at scale taking a greater market share.

About the author: Susan Taylor is a senior research analyst with the commodity insights team at S&P Global. She provides research coverage on energy storage markets across Europe, the Middle East, and Africa, with a focus on emerging technology and cross-sector integration. She previously worked as an analyst with the policy team at the European Association for Storage of Energy, in Brussels.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Very in deepth analysis ,need more up to date research on lithium batteries