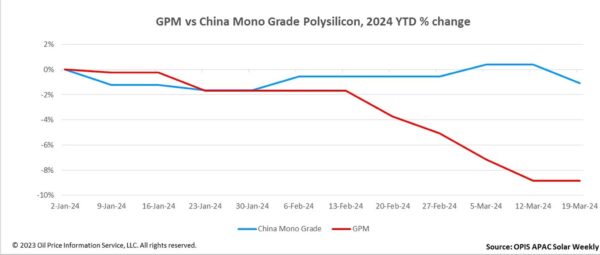

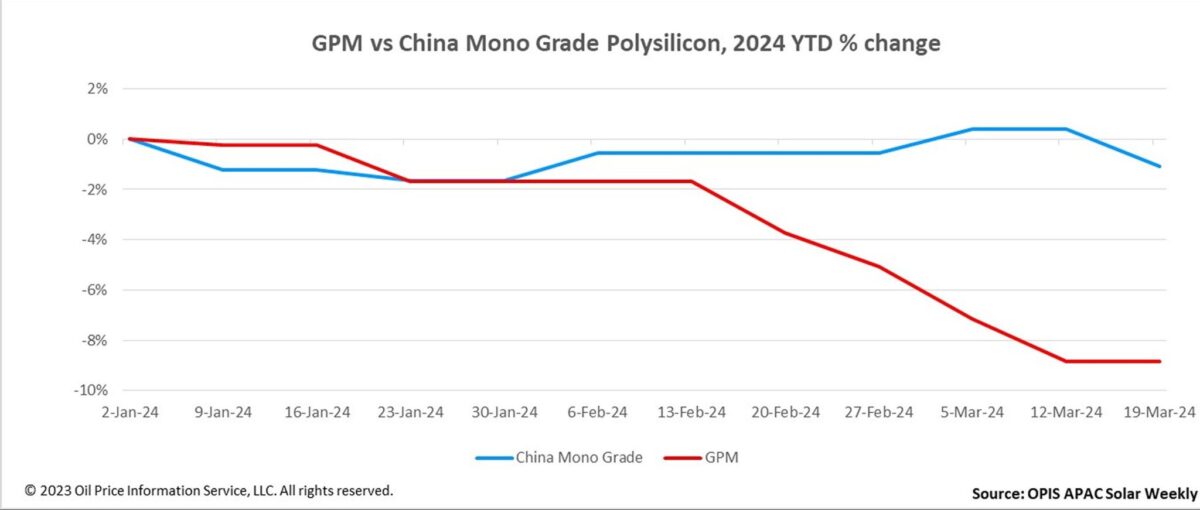

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, remained steady at $23.813/kg this week, unchanged from the previous week, reflecting stable market fundamentals

A source familiar with the global polysilicon market told OPIS that prices are poised to fluctuate within a fair range, as the dynamics of supply and demand in the polysilicon market outside of China are not anticipated to undergo significant changes in the short term.

In parallel, it was reported last week that construction has commenced on a solar-grade polysilicon facility in Oman, boasting an annual output of 100,000 MT. According to a source with knowledge of this project, construction is expected to finalize by the third quarter of next year, with trial production slated to commence in the fourth quarter. If all proceeds as planned, the factory could potentially generate a polysilicon output ranging between 10,000 to 20,000 MT by the end of 2025.

According to a polysilicon market source based in China, the primary advantage of the Oman project, as a polysilicon plant outside of China, stems from its cost-effectiveness strategy. The production equipment was sourced from China and China National Chemical Engineering Sixth Construction was engaged as the project contractor. The latter has worked on numerous polysilicon projects by major Chinese companies. Furthermore, the industrial park housing the Oman polysilicon project accommodates an additional metal silicon project with an annual production capacity of 50,000 MT, further contributing to cost reduction of the polysilicon project, the source added.

A market observer highlighted that if the cells and modules manufactured using the low-cost polysilicon from the Oman factory in the future are deemed compliant with the regulation mandating supply chain traceability for products imported into the US, it could potentially exert pressure on prices across the global polysilicon market.

China Mono Grade, OPIS’ assessment for polysilicon prices in the country were assessed at CNY60.33 ($8.34)/kg this week, down CNY0.92/kg, or 1.50% from the previous week, reflecting buy-sell indications heard.

Numerous sources attribute the recent decline in polysilicon prices primarily to the influx of low-priced offers from Tier-2 and Tier-3 polysilicon factories, resulting in an overall market price decrease. These manufacturers are motivated by two factors: the need to clear existing inventory and the desire to prevent further stockpiling, driving them to actively sell their products at prices ranging between CNY55/kg and CNY58/kg.

Contrarily, prices from Tier-1 polysilicon companies remain relatively stable. This stability stems from their capability to produce premium P-type polysilicon, which is well-suited for n-type downstream products.

As noted by a market observer, there is currently an excess of 100,000 mt of polysilicon inventory in the market, roughly equivalent to more than two weeks’ worth of production. The bulk of this inventory consists of polysilicon unsuitable for n-type downstream products.

The source added that to address these inventories, some polysilicon producers have implemented a bundled sales strategy. This entails requiring customers interested in purchasing n-type polysilicon to also acquire P-type polysilicon simultaneously. To incentivize this, polysilicon producers offer a certain discount on the overall price of the bundled purchase.

According to a downstream source, the prevalent high inventory of wafers, along with deliberations by some wafer factories to scale back production, suggests a looming possibility of a short-term decline in polysilicon prices, owing to the anticipated weakening demand.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.