From pv magazine Global

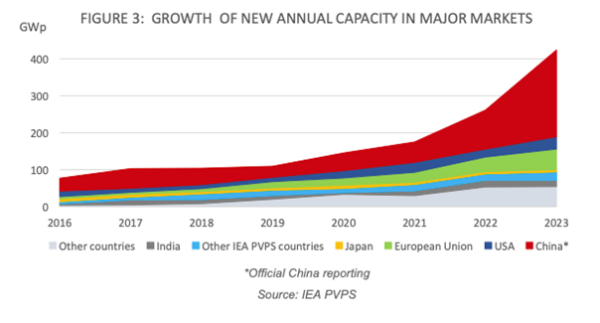

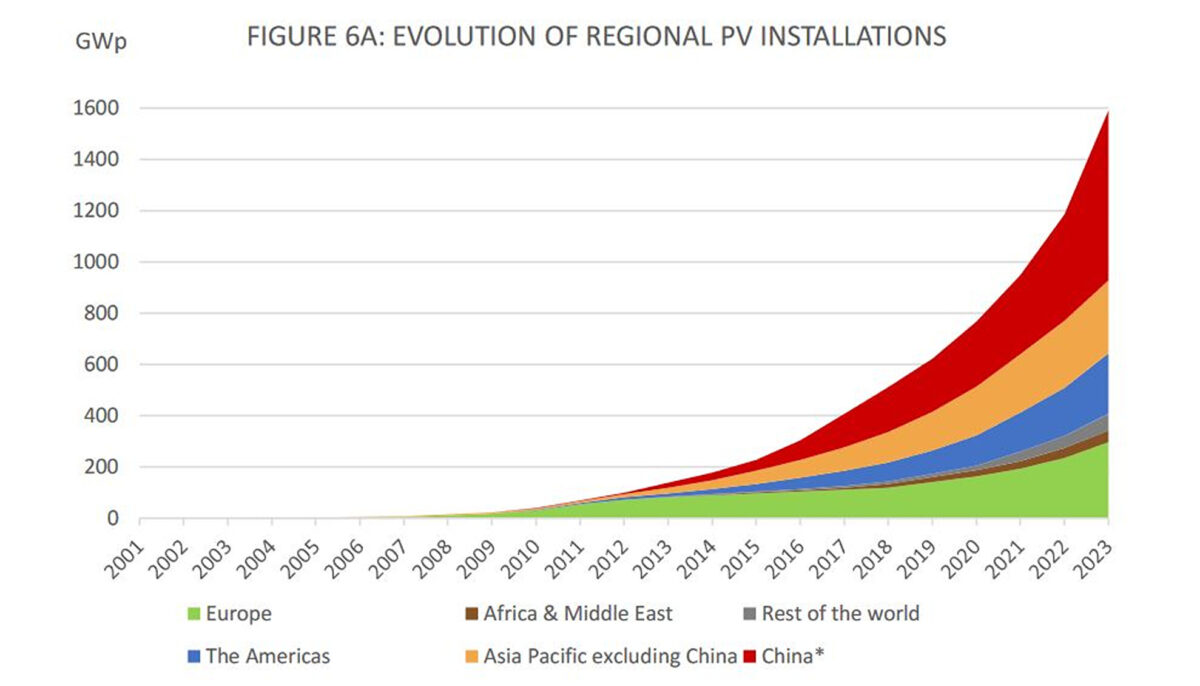

In 2023, despite record volumes of photovoltaics installed, the year ended with uncertainty surrounding manufacturer profitability and a slower rollout for local manufacturing projects than expected in many proactive countries. The cumulative installed capacity reached 1.6 TW after adding an estimated 407 GW to 446 GW DC of new PV systems. Uncertainty surrounding the real conversion rate of registered AC volumes to DC power is leading to wider estimates as overall volumes grow. Built on methodologies that take into account the difficulties of reconciling a multitude of reporting methods the difference in volumes between lower and upper estimates has become so significant that they now equal major regional markets. The importance of harmonized registering methodologies is becoming more apparent as discrepancies make it increasingly difficult for national statistics to give a clear picture of import and export values and natural market capacities. Until such methods become widespread, expert studies will be needed for a better understanding of market volumes and dynamics.

Regional Market Insights: Growth Trends and Sustainability Concerns

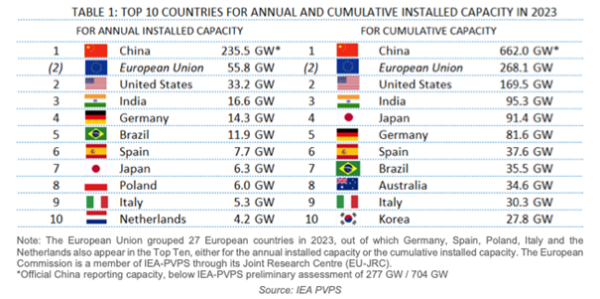

The upswing in the growth rate of the China market to above 120%, leading to 235.5 GW (official reporting) or 277 GW (IEA PVPS adjusted estimate), may not be sustainable; however, continued growth is still expected. Other key regional markets, including Europe (39% growth) and the USA (57%), also grew as the attractivity of PV is confirmed despite electricity market prices returning to levels seen before the Ukraine conflict – for example, in the European markets the range of €50 ($53.4)/MWh to €100/MWh is still high enough for PV to be competitive. Germany (14.3 GW), Spain (7.7 GW), Poland (6.0 GW) and Italy (5.3 GW) all installed more than 5 GW in 2023, while a dozen other European markets installed more than 1 GW. The USA market returned to a more expected level in 2023 after being constrained by grid connection queues and administrative procedures in 2022. Meanwhile, Brazil, the other strong market in the Americas, continued the previous year’s trends, adding another 11.9 GW. India, the third key national market after China and the USA, is still framed by barriers including grid access, administrative procedures, and financing. It installed 16.6 GW.

Image: IEA-PVPS

This evolution of the global market, where, despite record low module prices, regional markets outside of China had mostly steady increased growth, was insufficient to absorb all the overcapacity, and is a strong indicator that in many markets’ lowering module prices is no longer a significant lever for massively developing new capacities.

Manufacturing dynamics: oversupply, pricing pressures, and technology shifts

The oversupply of PV modules in 2023 has shed light on the difficulty of aligning production and demand in an international market driven by both market forces and different national policies. The continued increase in manufacturing capacity in China largely outstripped the market’s ability to absorb new module availability. Domestic demand in China, pulled by favorable local policies led to over 235.5 GW ensuring that a part of the oversupply was absorbed. Elsewhere, high but insufficient growth has led to an estimated worldwide stock in the order of 140 GW – enough to supply markets outside of China for a year.

Image: IEA-PVPS

The mainstream industry bringing new manufacturing capacity online is transitioning from PERC to TOPCon (amongst other n-type technologies), and this, combined with the increase in manufacturing capacity, created a more than competitive situation in the module market. As manufacturers dropped module prices through the year to move inventories of both older, less performing PERC technologies and newer TOPCon technologies, buyers have been in a position to acquire modules at extremely competitive low prices. The increasing controversy surrounding the record-low late 2023 module prices on the international market has led to industry discussion on unsustainable price dumping, particularly in Europe where Chinese modules represented more than 95% of imported modules, a level much higher than that supplying the Indian import market (about 60%), for example.

Navigating toward sustainable growth: the need for support policies and industry Strategies

These low prices have not been able to move all inventories and impacted profitability and new manufacturing projects. At the beginning of 2024, several Chinese manufacturers that remained largely viable in 2023 called for urgent measures in China to avoid the entire industry collapsing, as did smaller manufacturers outside China. In other countries, the expectation that new jobs in the now mainstream photovoltaics manufacturing sector could compensate for jobs lost in the fossil sector can only be met if strong support policies are deployed given the context of extremely competitive products coming from China – but effective policies have promising results as in the USA, Türkiye, or India.

The insights from the “Snapshot of Global PV Markets 2024” report underscore the pressing need for concerted action and strategic planning within the PV industry. Global market dynamics in 2023 have demonstrated an increasing desire to “future-proof” the industry through a more equitable geographical distribution of manufacturing capacity, built with sincere collaborations across the value chain and taking advantage of the strong competencies around the world. Proactive measures and collaborative initiatives will be pivotal in shaping a thriving and sustainable global PV market for the years ahead.

For more details, find the report here.

Author: Melodie de l’Epine.

This article is part of a monthly column by the IEA PVPS programme.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.