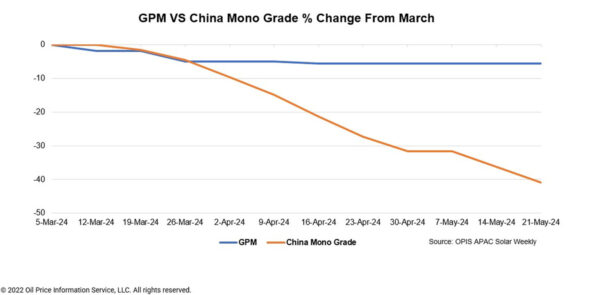

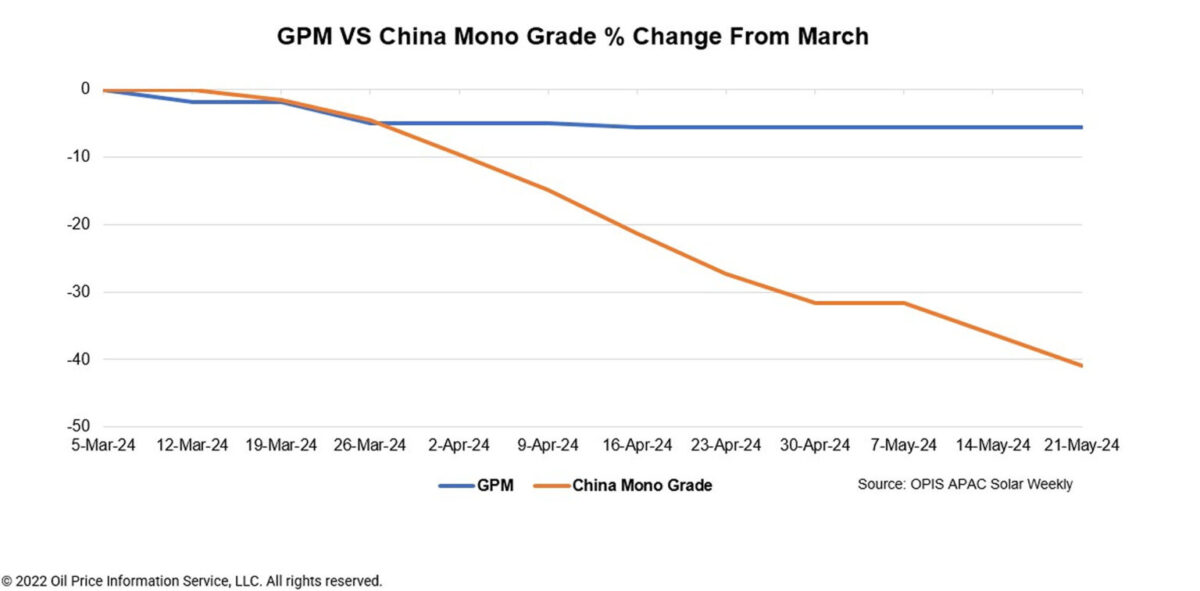

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $22.90/kg this week, unchanged from the previous week, reflecting stable market fundamentals.

Recent discussions have pointed to a potential slowdown in global polysilicon sales, attributed to shifts in international trade policies.

An upstream insider noted that the reinstatement of the Section 201 tariff on bifacial modules from four Southeast Asian countries by the U.S. in June will hinder the export of solar products from Southeast Asia to the U.S. market. Additionally, the U.S. Department of Commerce (DOC) has initiated investigations into solar cell and module imports from these countries under antidumping and countervailing duty (AD/CVD) regulations, causing a slowdown in trading activities in the region. Consequently, this has led to a significant decrease in the operating rate of Southeast Asian production capacity.

“As a result, the sales pace of polysilicon made outside of China, primarily destined for Southeast Asia, is expected to slow down,” the source added.

A source from a global developer anticipates this situation will become more pronounced in the second half of this year. “There won’t be much demand for modules from the U.S. in the second half of 2024 because the modules required for installation throughout 2024 have already entered the U.S. before the first quarter of 2024,” she added. It may take until 2025 for the sales situation of global polysilicon suppliers to revive.

The source therefore predicts that global polysilicon may accumulate some inventory in the second half of 2024, potentially leading to a price drop.

Another source knowledgeable about the global polysilicon market holds a contrasting view, asserting that global polysilicon prices are ultimately tied to end product prices. Despite recent reports of a rise in spot prices for modules in the U.S. to $0.4 per W, photovoltaic power generation remains the lowest levelized cost of electricity (LCOE) among available electricity sources in the U.S. Hence, there is still a possibility of further price increases for modules in the country, which, in turn, could help sustain the premium of global polysilicon prices.

China Mono Grade, OPIS’ assessment for polysilicon prices in the country was assessed at CNY36.167 ($5.09)/kg this week, down CNY2.833/kg, or 7.26% from the previous week. With no increase in the pace of polysilicon procurement by wafer companies, polysilicon inventory continues to accumulate, further putting pressure on prices.

According to a China-based upstream source, the price of polysilicon used for n-type products from Tier-1 producers ranges between CNY40/kg and CNY43/kg, while that from Tier-2 and smaller producers ranges between CNY36/kg and CNY40/kg. The price for Fluidised Bed Reactor (FBR) granular polysilicon used in N-type products has dropped below CNY35/kg.

“With the current price nearly falling below the cash cost for all polysilicon manufacturers, polysilicon companies are facing an average loss of nearly 40% at prevailing prices,” the source added.

Amidst the continual increase in inventory, uncertainty looms over when polysilicon will halt its price decline and stabilize within the industry, according to a market observer. The observer further explained that reports indicate polysilicon inventory is currently close to 400,000 MT, approximately equivalent to nearly two months of production.

Numerous insiders reported that multiple polysilicon producers are undertaking production halts or maintenance to navigate the sluggish market conditions. According to a market participant, most Tier-1 producers have shut down their old production lines, while some second and third-tier manufacturers with polysilicon production capacity in Ningxia Autonomous Region, Inner Mongolia, and Shaanxi Province have also initiated maintenance. Hence, it is anticipated that polysilicon production will decline month-to-month in May and June, though it remains uncertain whether this reduction in production will be sufficient to reverse the downtrend in prices, the source added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.