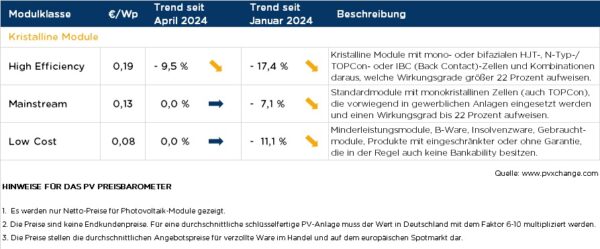

There has been little movement in the price of solar modules in the low-performance class this month. However, there was a significant price adjustment for modules with efficiency levels of more than 22%.

The prices of these modules, which are now mainly equipped with n-type/TOPCon cells and double-glass, are increasingly aligning with those of mainstream modules. There are only upward outliers for some types with interdigitated back-contact (IBC) or heterojunction (HJT) technology, which are not considered separately in this analysis.

Production volumes in China for n-type cells and modules appear to have increased, but the new customs situation in the United States might already be having an impact. The question is, what will this do to the European market? Increasingly lower prices would mean that demand would continue to rise if it weren’t for several disruptive factors.

There are still larger stocks of modules produced in 2023 or earlier at distributors, but also among installers themselves. However, if these measure 2 sqm in size, they are selling poorly due to their low performance. Building owners usually want to see high performance and the latest technology installed in new systems, which makes it much more difficult for existing goods to sell.

Despite the expected reduction in module production and import volumes, more Asian modules are still reaching the European market than are currently in demand. This is causing inventories to grow, even for high-performance models, putting additional pressure on module prices.

Inventories of old modules, which were produced and purchased at significantly higher prices in the past, must therefore be continually devalued. However, this is not possible for all players, which means that there are very different prices for modules with PERC technology in the market. Overall, the price difference between these categories is increasingly shrinking.

Africa and Southeast Asia will probably also become oversaturated with modules and Chinese products cannot be sold to the US market. One strategy that is becoming popular is to accommodate the soft factors of the commercial business – that is, payment and delivery conditions. Instead of offering modules at lower prices, credit lines are granted – often without requiring collateral – and free delivery is promised. However, it is doubtful that this tactic will work over the long term. Many smaller companies, in particular, are on the brink and imminent payment defaults cannot be ruled out.

Some suppliers also take refuge in online marketplaces, where they try to quickly sell their stock goods to international customers without incurring sales and marketing costs. But the competitive pressure there is also great and such goods can often only be sold at dumping prices. The other issue is that there is hardly any way to get to know the potential business partner in advance –you have to take what you get.

Misunderstandings can arise in business transactions, especially across national borders, and online platform operators are not always available to provide support and advice. The efforts involved in running an online business quickly become greater than purchasing or selling within an established business relationship.

My preference for using surplus older modules is clear: installing them in larger open-space or rooftop systems. The often smaller formats are not a bad choice, especially in areas with higher wind or snow loads. The material and assembly costs increase slightly in favor of better statics, but the easier handling makes up for the disadvantage.

And there is another undeniable advantage: the modules are already in stock and are therefore guaranteed to be available, meaning there can be no delivery problems and thus delays in the construction process. You may also find a few unsold inverters and cable reels, and then the components for your PV system are almost complete.

Once a system has been built and connected to a network, nobody is interested in whether the modules are of the very latest generation or not. In any case, the resulting assets can be sold.

Image: pvXchange.com

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.