From pv magazine USA

As the United States reassesses its shrinking manufacturing base relative to China’s expanding influence and considers the global geopolitical landscape, solar panel import tariffs continue to play a pivotal role in shaping the industry. Solar modules are now the world’s leading source of new energy, and international relations often hinge on energy politics. This is exemplified by the current war in Europe, which was precipitated by Russia using its gas resources to slow the continent’s response to its invasion of Ukraine, leading to a massive increase in the adoption of photovoltaics across the continent.

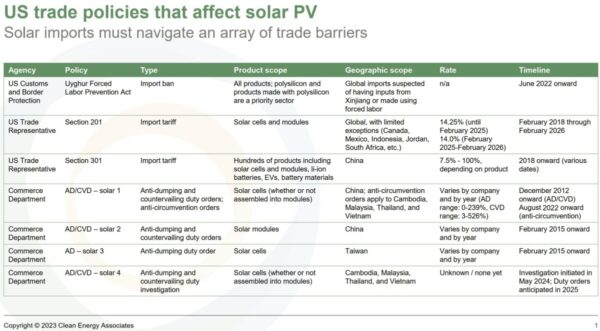

Since October 10, 2012, the Commerce Department, then under President Barack Obama, has subjected all solar modules containing key components from China to an import tariff. Now, in 2024, as the solar industry strives to fully scale and establish itself, the U.S. has imposed five import tariffs, one geographical import ban, and has also recently initiated an additional tariff case now under investigation.

Christian Roseland, an analyst at Clean Energy Associates, released a document titled “US Trade Policies That Affect Solar PV.” This document lists seven policies:

2012

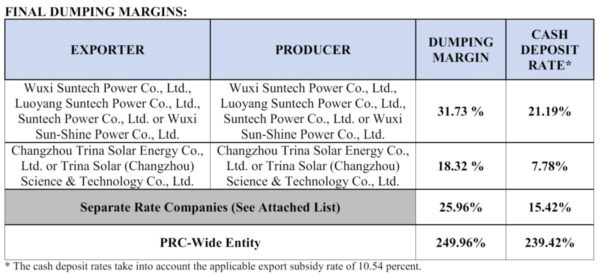

Starting from the oldest, the original Antidumping and Countervailing Duties (AD/CVD) case of 2012 was applied to all solar cells originating in China. According to a fact sheet from the U.S. International Trade Administration, the Commerce Department found that “Chinese producers/exporters have sold solar cells in the United States at dumping margins ranging from 18.32 to 249.96 percent. Commerce also determined that Chinese producers/exporters have received countervailable subsidies of 14.78 to 15.97 percent.”

Although Suntech and Trina were most publicly associated with these solar panel import tariffs, the ruling covered all solar cells from China, including 59 additional companies explicitly named in the document.

2014

While it didn’t technically affect solar cell prices, in 2014, the Obama administration charged “Five Chinese Military Hackers for Cyber Espionage Against U.S. Corporations and a Labor Organization for Commercial Advantage.” These charges stemmed from the theft of “thousands of files including information about SolarWorld’s cash flow, manufacturing metrics, production line information, costs, and privileged attorney-client communications relating to ongoing trade litigation, among other things.”

2015

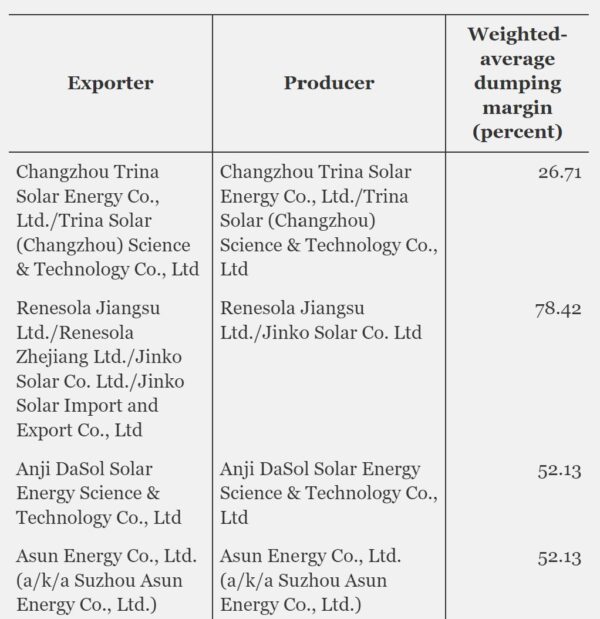

In February 2015, a second pair of duties targeted solar modules assembled in China and solar cells from Taiwan. The solar module duty focused on Trina and was extended to include Jinko Solar. It applied to all companies assembling solar modules in China using solar cells from any manufacturing hub. It was determined that China had started to manufacture cells outside its borders, only to import them later for module assembly. The second ruling aimed to curtail Chinese companies that were specifically investing in the production of solar cells in Taiwan for subsequent reimportation into China.

The tariff rates were 26% for Trina, 78% for Jinko, with a standard 52% for a large number of companies. Companies not on the original list faced a nationwide tariff of 165%.

2018

Following lawsuits by Suniva, the Trump administration implemented two additional tariffs: Section 201 & Section 301, applying to solar modules and hundreds of other items, respectively. The Section 201 tariff imposed a 30% import tariff on all solar modules from all countries, decreasing 5% annually until its scheduled end. The Biden administration later extended this tariff.

Initially, the Section 201 tariff excluded bifacial solar modules, as no significant U.S. production existed. However, as the U.S. module manufacturing base began to scale, the Biden administration recently reinstated a 15% tariff on bifacial modules.

2022a

The Uighur Protection Act aimed to ban all materials coming from the Xinjang region of China, identified as originating from forced labor. This region is noted for its solar polysilicon production, facilitated by inexpensive coal-powered electricity. As a result, significant volumes of solar modules were blocked from entering the U.S. by Customs.

In response, many solar manufacturers began to shift their sourcing of solar polysilicon away from this region, including all products coming into the United States. To prove the origin of the product, the industry has started to develop supply chain verification techniques, and some Chinese solar manufacturers have initiated agreements with international polysilicon groups.

2022b (2012 – Part 2)

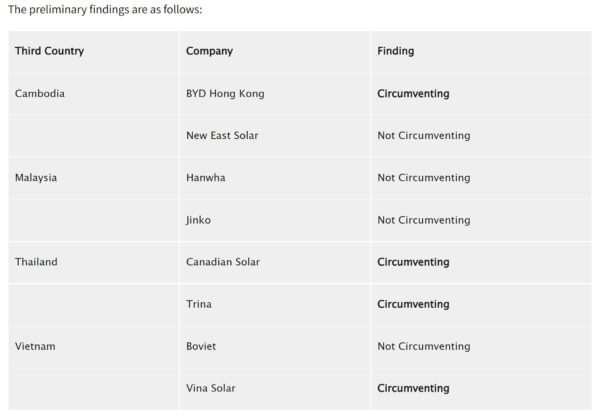

After a lawsuit was dismissed in 2021 due to anonymity concerns, Auxin Solar filed an AD/CVD lawsuit targeting Chinese manufacturers who had relocated solar cell and module production to Southeast Asia, claiming these actions violated the 2012 circumvention ruling. In winter 2022, the ruling confirmed circumvention by four companies, while another four major companies were found compliant.

The ruling specified that Chinese-origin solar cells would not be tariffed if at least three of six key subcomponents, including silver paste, aluminum frames, glass, backsheets, ethylene vinyl acetate sheets, and junction boxes, also originated outside of China.

President Biden paused the resultant tariffs for two years to foster the expansion of the U.S. solar industry, aligning with the goals of the inflation Reduction Act. The suspension was strategically planned to bolster the manufacturing and installation sectors of the solar industry during a critical growth period before any reductions in imports were enacted. Recently, Auxin challenged this decision by filing a lawsuit against the pause. This tariff suspension is scheduled to conclude on June 6, 2024.

2024a (2018 Part 2)

The current administration has extended and increased tariffs under the Section 301 ruling established in 2018, now covering solar cells, as well as batteries for cars and grid storage. The tariff on solar cells has risen from 25% to 50%, and battery cells have seen increases up to 25%. Today, importing solar cells from China, which cost between a few cents to a nickel per watt, would see a tariff increase from $0.0125/Wdc to $0.025/Wdc with this hike.

2024b – Pending Investigation

A petition filed by the American Alliance for Solar Manufacturing Trade Committee, which includes First Solar, Qcells, Meyer Burger, REC Silicon, and others, claims that the U.S. “manufacturing renaissance” is threatened by heavily subsidized Chinese cells and modules. These are alleged to be in violation of antidumping and countervailing duty (AD/CVD) laws.

The petition advocates applying the logic of the 2012 and 2015 AD/CVD rulings, which contend that certain countries hosting solar cell and module assembly factories – Cambodia, Malaysia, Thailand, and Vietnam – are unfairly subsidizing those factories, affecting all crystalline solar cell and panel manufacturers in those countries.

In their filing, the group says, “Although the Petitioner does not identify specific subsidy rates from the Subject Countries, the Petition alleges that solar cells and modules are imported and dumped in the U.S. market at the (above) margins.” The rates alleged are 70.35% for Thailand, 81.24% for Malaysia, 127.06% for Cambodia, and 271.45% for Vietnam.

How to apply solar panel import tariffs

Solar tariffs are collected by customs agents. While the buyer ultimately pays for the tariffs in the long run, the immediate financial responsibility depends on the import technique – EXW, FCA, DDP, etc. This determines who writes the check at the moment of import approval and who might be responsible if the amounts are incorrect or if evolving laws change the tariff amounts.

When calculating the AD/CVD and Section 201/301 tariffs, each tariff percentage is applied to the purchase price of the product. Among the four AD/CVD tariffs, a single charge is applied, but this only pertains to modules from specific regions. Conversely, both the Section 201 and 301 tariffs are imposed on all solar modules globally.

For example, if a solar module costs $0.10 per watt, then the Section 201 tariff at 15% would add $0.015 per watt, and the Section 301 tariff at 50% would add $0.05 per watt.

For a 2015 AD/CVD non-compliant solar module, the tariffs would vary significantly by manufacturer and country. For instance, when importing from China, tariffs are 26% for Trina products, 78% for Jinko, with a standard rate of 52% applying to a large number of companies. Non-listed companies would face a 165% tariff, leading to additional costs ranging from $0.026 to $0.165 per watt due to tariffs.

Should the 2024b tariff be applied as proposed, tariffs would increase costs significantly, adding $0.07035 per watt for modules assembled in Thailand up to $0.27145 per watt for those from Vietnam. However, none of these countries would have the Section 301 tariff applied, as that tariff only applies to products manufactured in China.

In total, a solar module initially costing a dime per watt could eventually cost between $0.191 and $0.38 per watt – an increase of 91% to 286%.

In comparison to the Inflation Reduction Act

Solar panel import tariffs are primarily intended to support the development of a new U.S.-based solar module manufacturing supply chain, which is financially backed by the Inflation Reduction Act. This act introduces a series of tax credits designed to bolster domestic manufacturers.

For solar modules, the credits are as follows:

- Solar cells: 4 cents per direct current watt of capacity

- Solar wafers: $12 per square meter

- Solar grade polysilicon: $3 per kilogram

- Polymeric backsheet: 40 cents per square meter

- Solar modules: 7 cents per direct current watt of capacity

For inverters, the credit varies depending on the type and is applied per watt of alternating current:

- Central inverter: 0.25 cents

- Utility inverter: 1.5 cents

- Commercial inverters: 2 cents

- Residential inverters: 6.5 cents

- Microinverters: 11 cents

Additionally, torque tubes for racking will receive a credit of $0.87 per kilogram, and structural fasteners will receive $2.28 per kilogram. Detailed information on these production credits is available starting on page 414 of the Inflation Reduction Act.

Author: JOHN FITZGERALD WEAVER

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.