ESS Tech, listed on the New York Stock Exchange as “GWH”, announced it has secured a $50 million investment from the Export-Import Bank of The United States (EXIM).

The funds are expected to support the expansion of ESS production capacity at its Wilsonville, Oregon plant. The company develops long-duration energy storage iron flow batteries. The investment is expected to help ESS triple its manufacturing capacity at the Wilsonville plant.

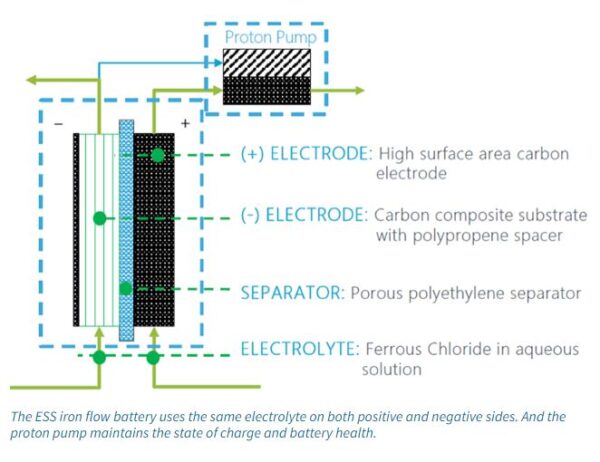

“Our technology uses earth-abundant iron, salt and water to deliver environmentally safe solutions capable of providing up to 12 hours of flexible energy capacity for commercial and utility-scale energy storage applications,” said ESS Tech.

EXIM made the investment via its Make More in America Initiative, which makes available medium- and long-term loans, loan guarantees, and insurance to finance export-oriented domestic manufacturing projects.

ESS Tech is delivering iron flow energy storage systems to customers in Europe, Australia and Africa. The company manufactures 100% of its products in the United States, with a predominantly domestic supply chain that spans 29 states.

“Our partnership with EXIM underscores the critical role that American-made clean energy technology will play in the global clean energy transition,” said ESS chief executive officer Eric Dresselhuys. “ESS’s iron flow technology is already deployed in Australia and Europe and with this agreement, we are well positioned to meet the growing needs of our current and future global customers.”

ESS battery systems are designed to operate for 25 years, while conventional batteries last about 7 to 10 years. The battery modules, electrolyte, plumbing, and other components may well last for decades longer with proper maintenance, said the company. The battery, for example, is expected to experience zero degradation over 20,000 cycles. The long duration energy storage (LDES) system can store and dispatch electricity for 12 hours or more.

According to the Department of Energy’s ‘Pathways to Commercial Liftoff: Long Duration Energy Storage’ report, the U.S. grid needs 225 to 460 GW of LDES capacity for power market application for a net zero economy by 2060. The global LDES market is estimated to be $50 billion per year and forecast to grow significantly with a cumulative investment of up to $3 trillion by 2040, according to the LDES Council and McKinsey & Co.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.