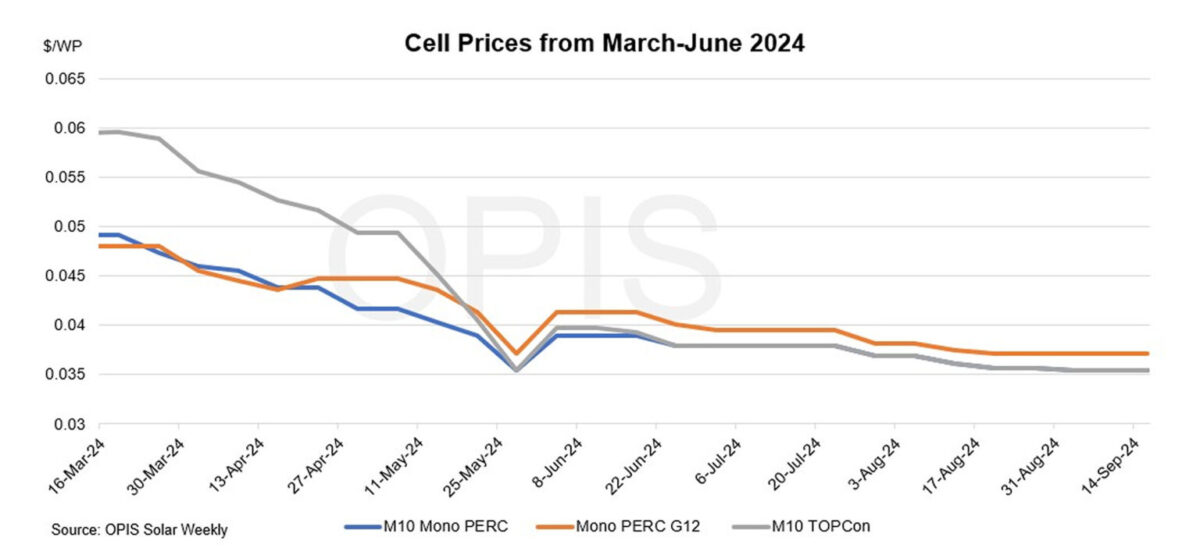

Cell prices were assessed stable in the week to Tuesday as the Chinese market remained closed during September 15-17 for the Mid-Autumn festival. The FOB China Mono PERC M10 cell and TOPCon M10 cell prices were flat at $0.0354/W while the FOB China Mono PERC G12 cell prices were assessed unchanged at $0.0372/W week-to-week in the absence of trading activity.

Demand was sluggish with market participants sidelined by the holidays. The recent price declines in the cell segment, amid uncertainties about when this downward trend would stop, also dampened sentiment. M10 PERC cell prices fell by 21.68% since January this year, while M10 TOPCon cell prices fell by 39.4% over the same period to Tuesday, according to OPIS data.

A further reduction in cell prices would result in cell producers shutting production lines as current cell prices were below the costs of production. On the other hand, some market participants expect a slight increase in cell prices after the holidays as cell manufacturers have been mulling price hikes amid slight gains in the upstream wafer segment for the past few weeks.

In the domestic Chinese market, prices were stable. Mono PERC M10 and TOPCon M10 were assessed unchanged at CNY 0.290 ($0.041)/W, week-to-week while prices of Mono PERC G12 prices were flat at CNY 0.300/W from the previous week.

China exported about 4.65 GW of solar cells in July with the majority bound for India, an industry source said.

Outside of China, India’s Ministry of New and Renewable Energy (MNRE) is seeking feedback on draft guidelines for an Approved List of Models and Manufacturers (ALMM) specifically for solar cells, aiming for implementation on April 1, 2026, according to a memorandum issued September 7.

The memorandum stated that all projects under the purview of ALMM must source their photovoltaic modules from models and manufacturers included in the ALMM List-I for solar PV modules. These modules must, in turn, use solar PV cells from models and manufacturers in the ALMM List-II for solar PV cells.

U.S. trade officials on Friday locked in the new 50% Section 301 tariffs for cells, assembled into modules or not, out of China. Those will take effect on September 27. More interestingly, the USTR in the same notice proposed that the same tariff should apply to polysilicon and wafers out of China. This would push Chinese companies to rethink their supply chains entirely. The proposal on polysilicon and wafers will be subject to a public comment period, for which the details will be communicated separately.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.