Escalating tensions in the Middle East are once again set to increase global liquefied natural gas (LNG) prices, which raises questions on whether it is a good bridge fuel to the transition to clean energy, especially for importers like India, according to a new briefing note by the Institute for Energy Economics and Financial Analysis (IEEFA).

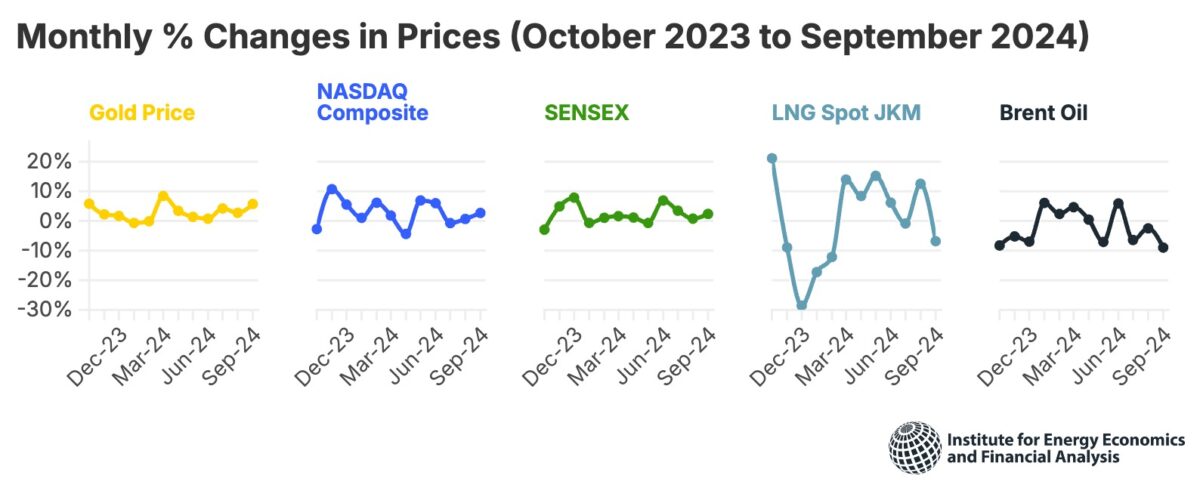

The note highlights that while various factors govern commodity prices, geopolitics has been the dominant driver of volatility in recent years. The note compares the volatility (Figure 1) in various commodity prices as well as stock market indices and finds that the sharpest moves have been for LNG prices.

“LNG price fluctuations have been extreme in months of minimum variability for other commodities, such as in October 2023 when LNG price jumped by 21%, only to drop by 29% in December 2023,” said the note’s author, Purva Jain, Energy Specialist, Gas & International Advocacy, IEEFA.

The note stated oil prices have shown signs of stress as geopolitical tensions increase, reaching $90 per barrel (bbl) on April 4, 2024, before easing over the northern summer months due to the subsiding of geopolitical tensions. The price went as low as $69/bbl on Sept. 10, 2024 before spiking to $81/bbl on Oct. 8 amid rising Middle East tensions. LNG futures for 2025 are already at $13 (INR 1,093) per million British thermal units (MMBtu), which raises major affordability concerns. If realised, $13/MMBtu would be double the regulated domestic gas price and well above India’s general affordable threshold of $10/MMBtu.

“India should re-evaluate its strategy of increasing reliance on LNG as a fuel amid persistent market volatility. Not only are LNG trade flows disrupted by geopolitical disturbances, but prices appear sensitive to many other factors, as the large swings in monthly prices over the past year demonstrate,” said Jain.

“A wiser strategy for India would be to invest in diversifying fuel sources and increasing the share of renewable energy in the energy mix to insulate the economy from entrenched LNG price volatility,” she adds.

The note also highlights that India’s focus on new technologies and inclination to gain global leadership in producing and exporting greener fuels could help it move away from LNG dependence. Green hydrogen and green ammonia, along with the increasing awareness of natural fertilisers, could lower the dependence on gas in the fertiliser sector, which has few alternatives.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.