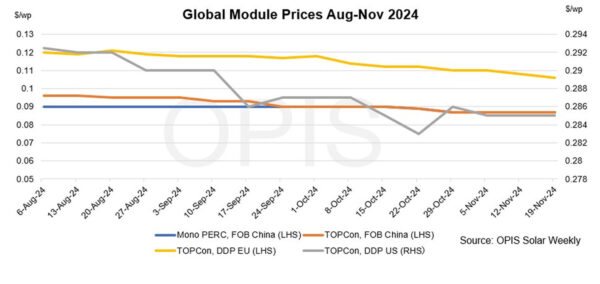

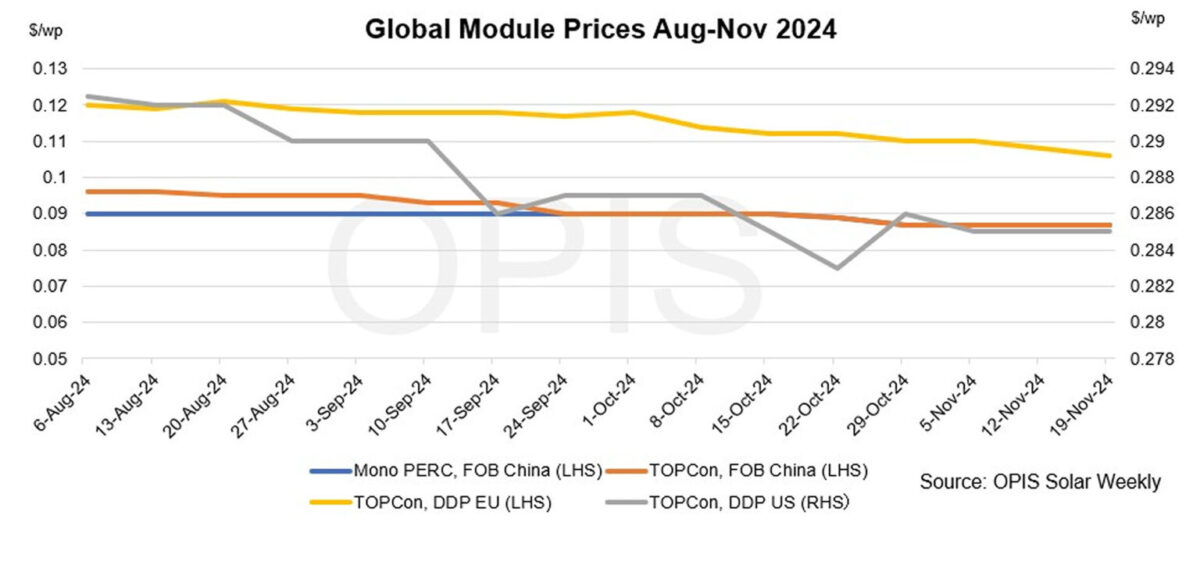

FOB China: The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China was stable at $0.087/W Free-On-Board (FOB) China, with price indications between $0.085-0.095/W.

Several Tier 1 manufacturers increased their offer prices following news of the export tax rebate reduction for photovoltaic products from 13% to 9%, effective Dec. 1. The affected products include monocrystalline silicon wafers larger than 15.24 cm in diameter and photovoltaic cells, both assembled and unassembled into modules.

A top-five Chinese manufacturer told OPIS that the lower rebates have led to contract renegotiations, though the full impact is still being assessed. Meanwhile, another industry source suggested a rebate reduction is unlikely to alleviate China’s oversupply issue, as manufacturers might shift additional costs to buyers.

In other policy updates, the Brazilian government raised the import duty on out-of-quota photovoltaic cells assembled into modules from 9.6% to 25% for certain companies. However, the in-quota tariff will remain at 0% until June 30, 2025.

DDP Europe: TOPCon module prices slipped 0.99%, with average values assessed at €0.100 ($104.7)/W and ranging between a low of €0.080/W and a high of €0.115/W for Tier 1 panels.

According to sources, prices from sellers ‘looking to decrease their stocks quickly’, have reached new lows of €0.055/wp, even surpassing the €0.06/wp threshold.

Freight rates published by Drewry for the China/East Asia-North Europe Ocean route climbed this week by 2% and were reported at $4,043 per forty-foot equivalent unit (FEU). This corresponds to $0.0095/W.

DDP US: Prices are stable week over week, with OPIS assessing the spot price for utility-scale TOPCon modules DPP U.S. at $0.285/W, while forward indications show the price slightly higher in the first quarter of 2025 at $0.296/W and Mono PERC modules for the same delivery period at $0.284/W.

While the industry continues to absorb the news of Donald Trump’s victory and its implications for future energy policy in the U.S., the import market is largely quiet. One major developer source said the spot price for TOPCon utility-scale modules continues to hover around $0.22-0.23/W for delivery from Indonesia and Laos, $0.25-0.26/W from India and $0.28-0.30/W from Vietnam, Malaysia, Cambodia and Thailand.

An installer source said prices for residential Mono PERC modules assembled in the U.S. with imported cells hover between the high $0.20/W and mid $0.30/W. The source is currently evaluating a deal to secure American modules for 2025 from a Tier 1 manufacturer at a price in the high $0.20/W.

The same source said they continue to see spot prices for residential modules from Southeast Asia priced between the high teens and low $0.20/W as manufacturers continue trying to sell down inventory, adding that much of the lower priced merchandise could be saddled with tariff risk related to the Dec. 3 utilization deadline.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.