From pv magazine Global

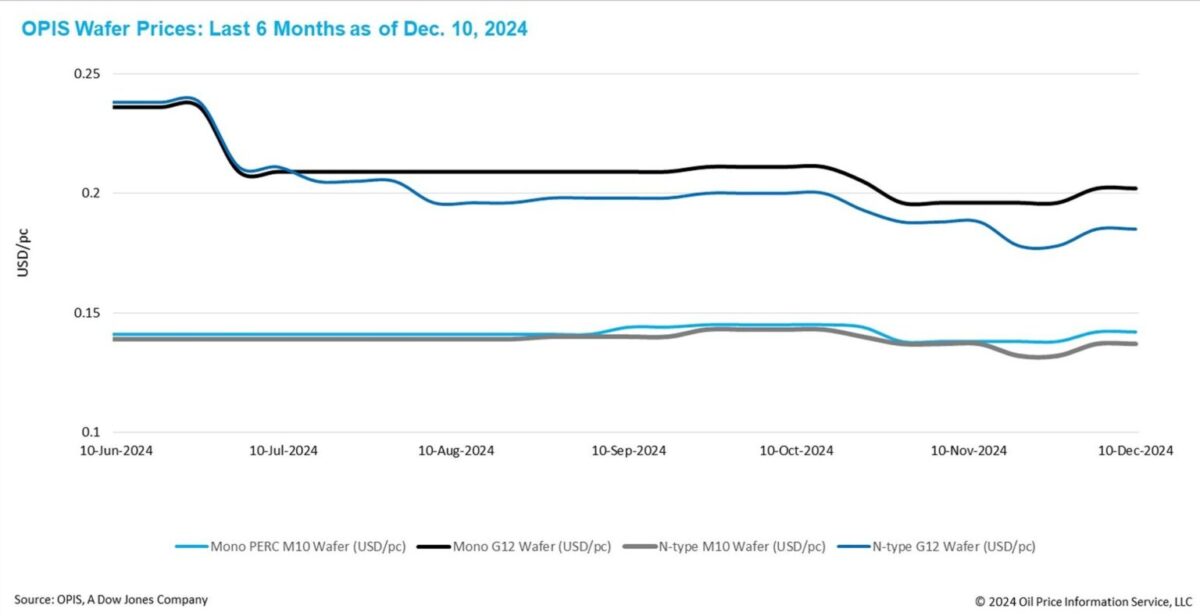

FOB China prices for Mono PERC wafers remained stable this week, with Mono PERC M10 and G12 wafers priced at $0.142/pc and $0.202/pc, respectively. Similarly, FOB China prices for N-type M10 and G12 wafers showed no week-to-week changes, holding steady at $0.137/pc and $0.185/pc, respectively.

The Chinese market has made notable progress in reducing wafer inventory levels. Reports indicate that the overall operating rate for ingot production in China remains below 50%. Additionally, wafer production in the country has been on a downward trajectory for three consecutive months since August. As a result, sources suggest that wafer inventories have now stabilized at a normal turnover level, equivalent to approximately two weeks of production.

Nevertheless, industry insiders hold limited optimism for the near-term outlook of the wafer market, citing the conclusion of the peak purchasing season. Reports suggest that some major cell manufacturers are planning to shut down operations at certain facilities and begin the Chinese New Year holiday as early as December, a month ahead of schedule.

With weak end-user demand likely to persist through the first quarter of next year worldwide, wafer manufacturers are expected to prioritize controlling production volumes and striving to maintain price stability in the near term.

Recently, several regions have introduced new policies in the solar market that could impact wafer production or trade. In China, multiple solar manufacturers have signed a self-regulatory agreement aimed at controlling production capacity across the entire value chain, including polysilicon, wafers, cells and modules. Tier-1 wafer manufacturers, leading integrated producers with wafer production capabilities, and major specialized wafer manufacturers have reportedly all signed the agreement. These companies have been reportedly allocated maximum permissible wafer production quotas, collectively totaling approximately 650 GW for 2025, representing a modest 2% growth compared to 2024 levels.

Market observers generally view the signing of the self-regulatory agreement and the allocation of capacity quotas as only an initial step towards clearing the excessive capacity. The agreement’s future implementation and effectiveness remain uncertain and are likely to face significant challenges.

In India, the Ministry of New and Renewable Energy (MNRE) announced this week that from June 2026, solar projects must use cells from List-II of the Approved List of Models and Manufacturers (ALMM). While the introduction of List-II is anticipated to boost domestic PV cell production in India next year, India’s limited ingot and wafer capacity may drive higher wafer imports in the short term.

In the U.S, the trade representative announced this week that, effective Jan. 1, 2025, tariffs on imported Chinese solar wafers and polysilicon will rise from 25% to 50%. This decision is intended to support domestic investments under the Biden-Harris Administration, aimed at fostering the growth of a clean energy economy.

Insiders believe this development could raise the cost of Chinese wafer exports to the U.S, undermining their market presence or potentially driving up solar cell and module prices in the region. While U.S wafer imports from China are already minimal due to limited domestic cell production, the expansion of U.S cell production may prompt Chinese companies to accelerate the establishment of overseas facilities in regions like Southeast Asia and the Middle East.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.