From ESS News

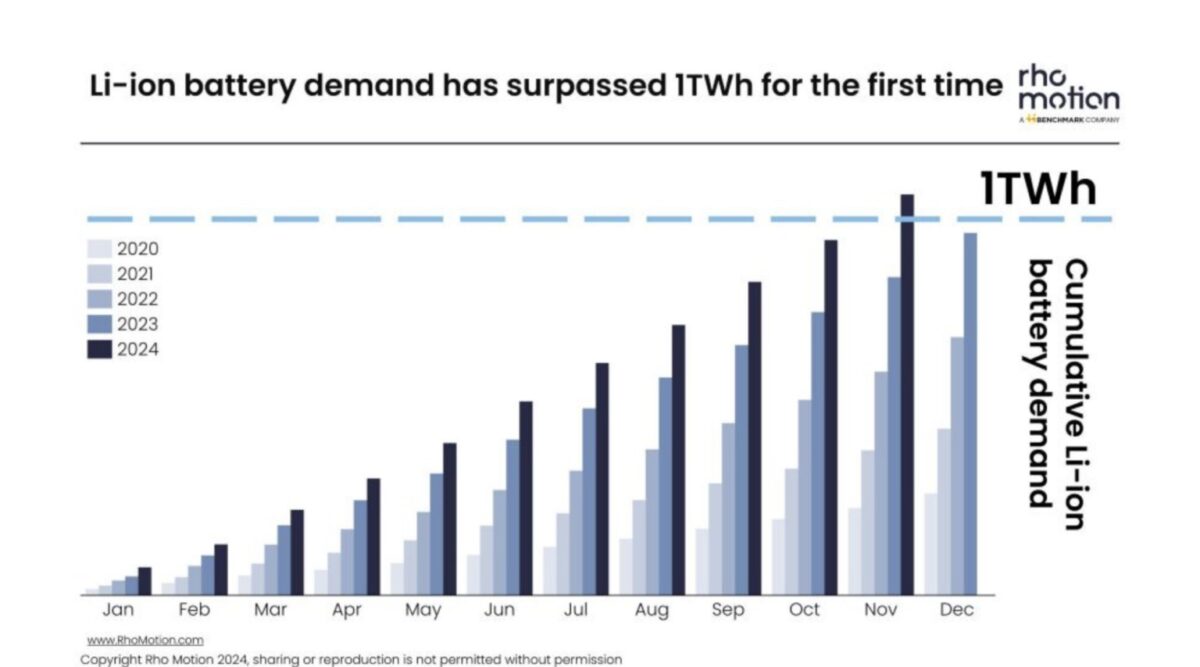

On the back of a record month for EV sales and strong BESS deployments in November, global lithium ion battery demand for the year has surpassed the 1 TWh mark, a milestone narrowly missed in 2023.

According to London-based Rho Motion, lithium-ion demand is set to increase 26% year-on-year in 2024 compared to 2023. The EV market continues to make up the majority of lithium ion battery demand, but is far lagging behind the impressive growth of the BESS market.

In recent years, the demand for lithium-ion batteries in stationary storage applications has doubled from 7% in 2020 to 15% in 2024, making it the fastest growing battery demand market.

November played a key role in the annual statistics for 2024. According to Rho Motion, it marked another record-breaking month for EV sales with 1.8 million units sold globally, and China accounting for over two-thirds of the figure.

Globally, the EV sales have grown by 25% year-on-year ending November. However, geographically the differences are stark. Europe shrank by 3% compared to January-November 2023, meanwhile China saw 40% annual growth so far this year.

Meanwhile, grid-scale BESS installations have grown rapidly in 2024 on the back of strong renewable deployments paired with record low cell and system prices. In November alone, the world deployed a cumulative 19.4 GWh.

This was the second highest monthly capacity of BESS deployed globally to date, and a year-on-year increase of 175%. Of the 127 projects to come online, three had more than 1 GWh of storage capacity. Gemini Solar near Las Vegas in the US was leading the chart, with a 1,416 battery energy storage system.

November marked China’s highest monthly deployment of 2024 with over 15 GWh entering operation.

Utility-scale, front-of-the-meter, standalone projects accounted for a lion’s share of BESS deployments in November, amounting to 76% of the cumulative global installations.

According to Rho Motion, the regions with highest concentration of standalone projects are the EU & EFTA & UK [90%], Asia Pacific Other [88%] and China [56%].

Pete Tillotson, senior research analyst at Rho Motion, tells ESS News that the reasons for this spread are often market specific.

“For example, the UK has predominantly seen standalone storage deployments to date since permitting and grid-connection constraints mean that a standalone storage project is more likely to gain connection. There are more connections available to those projects with a smaller load on the grid. This means that pairing a renewable asset at the point of interconnection makes both the development of and economics for that project more complex,” he says.

Interestingly, one of the three biggest projects which became operational in November is the largest operating vanadium redox flow battery to date. At exactly 1 GWh, the Xinhua Akesu Wushixian Energy Storage Project Part 2 is part of the Hami Shisanjianfang Wind + Storage Project in China.

Tillotson says that this project is indicative of the capability of the redox flow battery storage, noting that the technology still lags far behind lithium-ion BESS in terms of commercial viability.

“Technological developments, breakthroughs and deployments in the battery space have and continue to occur first in China, then disseminate globally,” Tillotson says. “Market mechanisms on the operating side of these long-duration technologies need to be ironed out first in order to make the technology financially viable to deploy in the market. Until that time, long-duration technologies will struggle to gain significant market share. However, this process is ongoing.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.