The government’s residential rooftop solar subsidy scheme PM Surya Ghar Muft Bijli Yojana (PM-SGMBY) has the potential to catalyze an INR 1.2 trillion ecosystem, with manufacturers of essential components, including modules, inverters, mounting equipment, and electrical components, anticipated to be primary beneficiaries alongside project developers and EPC players, says a new report by SBICAPS.

Solar module manufacturers have the largest market opportunity worth INR 480 billion, inverters INR 275 billion, electric components INR 200 billion, and mounting structures INR 90 billion.

The PM-SGMBY offers substantial capital cost subsidy that accelerates payback periods by 4-5 years. Within 10 months of its launch, the scheme has achieved 720,000 installations. This marks a ten-fold increase in monthly installations.

The report says the residential rooftop solar growth will accelerate if net metering benefits are extended to sub-1-kW consumers, low-cost financing is provided to the end consumer, and the problems of adequate space is addressed through high-wattage panels.

It adds that residential PV installations may surpass other segments in the rooftop solar space if PM-SGMBY achieves its ambitious 30 GW target

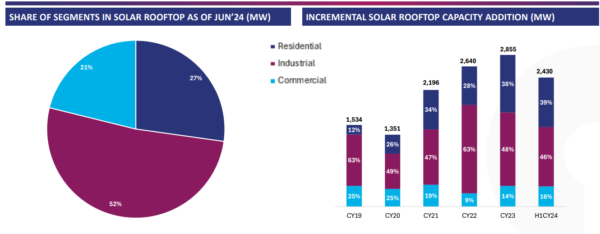

Currently, in the rooftop solar segment, commercial & industrial installations dominate with a 73% share against residential installations’ 27% as of June 2024. However, the report says, the residential segment’s share is steadily rising and is expected to reach a crescendo in the medium term due to capex policy support by the central government, especially in States with high residential tariffs and favourable net metering policies.

2024 installations

Year 2024 saw a surge in non-utility (rooftop + off-grid) solar installations. Of the 24.5 GW solar capacity added in CY 2024, 6 GW (25%) came from non-utility sources. Rooftop solar saw a 4.6 GW rise in CY 2024, a 53% year-on-year growth, while off-grid solar installations grew 197% YoY.

The SBICAPS report attributes the increasing share of the non-utility segment to a mix of low base, favourable government policies driving both the residential and C&I segments, and better affordability of distributed solar solutions

The C&I rooftop PV flourishes due to the inherent disparity between elevated C&I grid tariffs and reduced tariffs procured from third-party independent/captive power plants..

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Lack of proper information regarding dealers in one’s place.Quality of parts and afterwards service guarantee for at least 7 years.

If government of India wants a green power revolution in India , then it should provide 💯 percent subsidy to lower income groups and below poverty house holds for installation of roof top domestic Solar Installations . Also instead of waiting house holders to approach the Solar companies for installation of roof top systems , the companies them selves should approach and install the Solar Power 🔋 Roof Top Green Power Solutions in our country . Also subsidy componet for all other house holds should be increased upto 80 percent of installation cost so that a revolution in unleashed in the Solarr Roof top Installations in India .

Sangatech India Services Pvt Ltd company ready for manufacturing…solar plz help the same … Rajesh Sangwan…9315037029 9017337029. sangatech.india@gmail.com. Sangatech.india@sangatech.co.in

I need to know about solar panel installation and ditels about it