Tata Power and natural gas supplier MGL partner on e-mobility

This is Tata Power’s fourth major partnership with an energy retailer to expand its presence in the e-mobility business. As part of the MoU, the private-sector electricity generator with work with Mahanagar Gas Limited (MGL) to set up solar rooftop projects and commercial-scale electric vehicle (EV) charging and battery swapping stations.

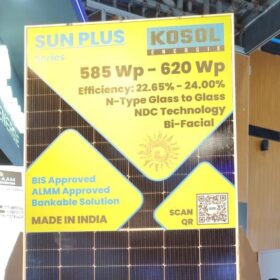

The long read: Implementing standards

While Bureau of India Standards certification is a genuine attempt by the Indian government to mitigate the risks associated with poor solar module quality, there are several reasons why it is not 100% effective. pv magazine India’s Uma Gupta investigates India’s efforts to ensure quality in its booming PV industry.

MNRE clarifies import of lead-acid batteries for solar PV applications

The import of secondary cells and batteries of lead-acid and nickel-based chemistries will be allowed subject to IEC 61427 certification of the product and certificate issued by the MNRE, along with an undertaking from the supplier that the products will be utilised for solar PV power projects only.

Opportunities beyond solar and EVs: Fortum interview

Waste-to-energy, battery lifecycle solutions and hazardous waste management will make up an increased share of Fortum’s business in future. While solar will continue to be a mainstay for the Finnish clean energy company in India, Fortum wants to deepen its presence in the electric vehicle space with smart solutions, according to Sanjay Aggarwal, the company’s India MD, and Juha Suomi, area director for Asia, who spoke exclusively to pv magazine.

Only two bidders for Gujarat’s 1 GW solar tender

The procurement – for PV capacity at the Dholera Solar Park – attracted bids for just 300 MW as developers shunned a tariff ceiling of Rs2.75/kWh.

Rooftop solar needs greater push to reach 2022 target: IEEFA

Policy certainty and more financial subsidies would incentivise the market, as would support for domestic manufacturing and simplifying the net metering application process.

Exicom and BHEL sign MoU on EV charging infrastructure

Under the partnership, projects will be sought on nomination as well as through competitive bidding. Exicom shall also help state-owned Bharat Heavy Electricals Limited (BHEL) to set up electric vehicle (EV) charger manufacturing facility for e-mobility business.

Vikram Solar panels are Black & Veatch certified

After a detailed review of solar panels manufactured at Vikram Solar’s plant in West Bengal, US-based Black & Veatch concluded that its modules successfully meet the requirements of respective international standards.

Belectric commissions 26 MW rooftop solar projects for Cleantech Solar

The German EPC contractor is also building a 250 MW AC ground-mounted solar farm in Karnataka. Overall, with an already installed capacity of more than 370 MWp and other projects under implementation, it expects to cross 1 GW of installed capacity in India by the year end.

Tackling India’s solar waste challenge

As the nation aims for 100 GW of solar capacity by 2022 it is staring at up to 1.8 million tons of PV waste by 2050. A solar waste management seminar organized by consultancy Bridge To India in New Delhi brought stakeholders together to discuss how a PV waste management system could help.